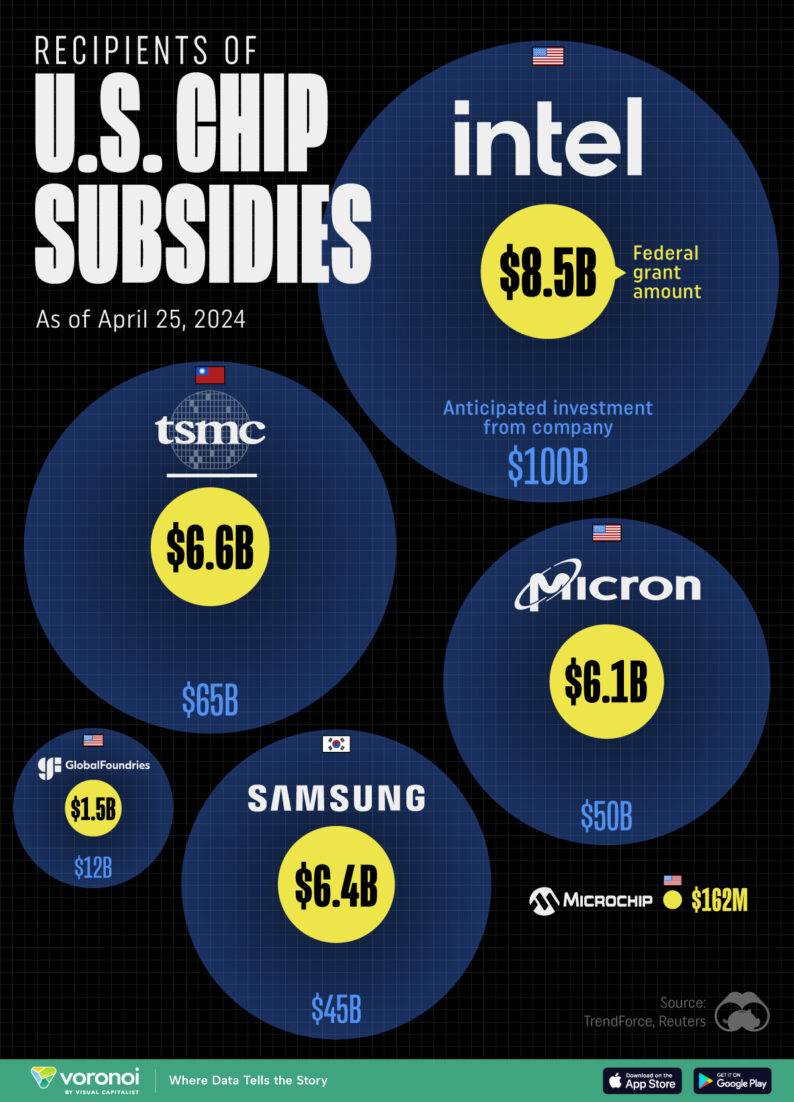

All of the Grants Given by the U.S. CHIPS ActThis visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden

Image Source: UnsplashIn the past week, American Airlines (AAL – Free Report), Southwest Airlines (LUV – Free Report), JetBlue Airways (JBLU – Free Report) and Hawaiian Holdings (HA – Free Report) released first-quarter 2024 results. While air travel demand was upbeat, high costs hurt results. First-quarter 2024 earnings-related updates were also provided in the previous week’s write-up. Recap