Existing Home Sales dropped 4.8% vs prior gain of 1.8%. This is disappointing and had been one of the better data point’s bulls and the Fed pointed to justify the economic growth as “solid”. Some of the highlights from trading

September 21, 2015

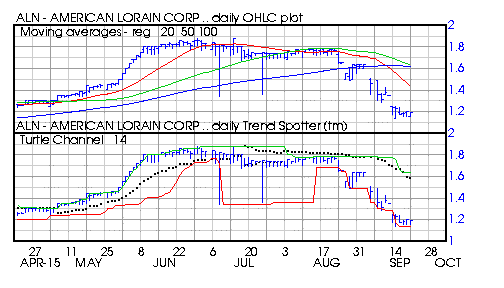

This morning I deleted American Lorain (NYSEMKT:ALN), Earthlink (NASDAQ:ELNK) and Axcelis Technologies (NASDAQ:ACLS) from the Barchart Van Meerten Speculative portfolio for negative price momentum. American Lorain Barchart technical indicators: 80% Barchart technical sell signals Trend Spotter sell signal Below its