Every day I see more propaganda about the American Dream of owning the home. I see the code words a $15 trillion dollar industry uses to hypnotize its religious adherents to BELIEVE. Lay down your money, your hard work, your lives and

October 9, 2015

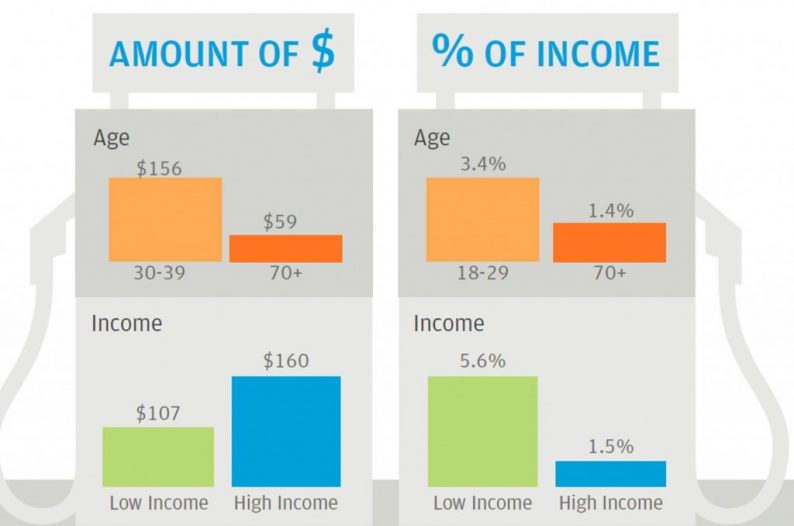

Trade prices continue to deflate year-over-year, and energy prices had little to do with this month’s decline. Import Oil prices were down 13.3% month-over-month, but export agricultural prices decreased 2.6%. with import prices down 0.1 % month-over-month,down 10.7 % year-over-year; and export prices down 0.7