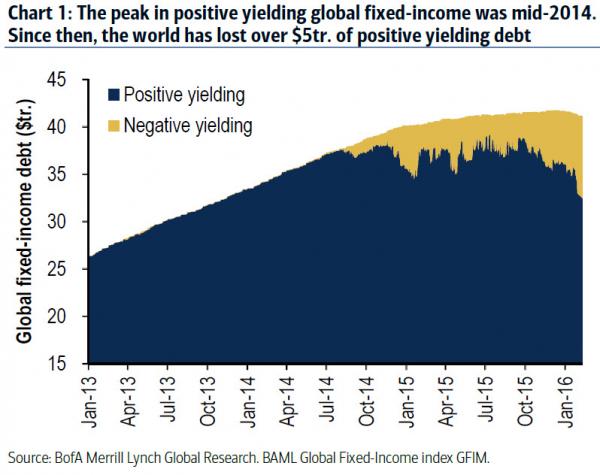

By ignoring unintended consequences – spinning around global monetary or interest rate policy moves (especially the trend toward negative rates we took to task quite extensively last night); the optimists rationalizations have instead rapidly moved to weaken the Street’s credibility to

February 2, 2016