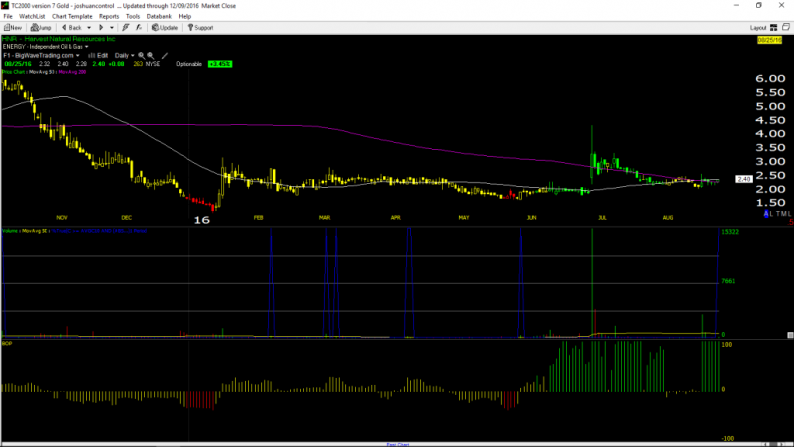

A lot of Trump trades have gained great favor over the past month. Twitter (TWTR) is one potential trade I am still waiting to pop. Trump’s Twitter habit is of course well-known and probably legendary at this point. As a result, Twitter

December 11, 2016