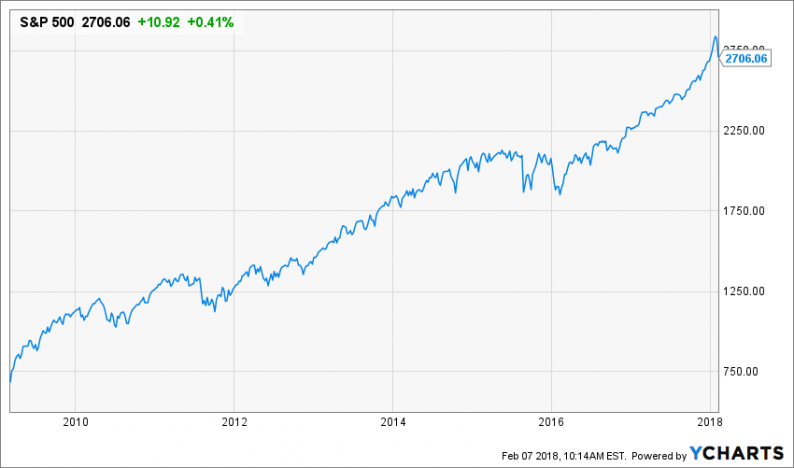

Flush. Rinse. Repeat. BTFD! Well, you could also give a good whack to the weak hands, burn the over-boughts, call in the sideline cash and get giddy about the fundur…mentals! After all, the man on bubblevision said nothing has changed since the January 25 high at

February 7, 2018