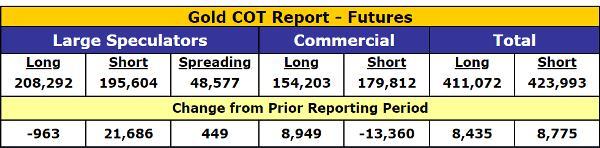

No need to mince words anymore. If the futures market still influences gold’s price, then that price is going to spike. And silver is better than gold. Since January, gold futures speculators have been trending from extremely bullish to scared short. And

August 10, 2018