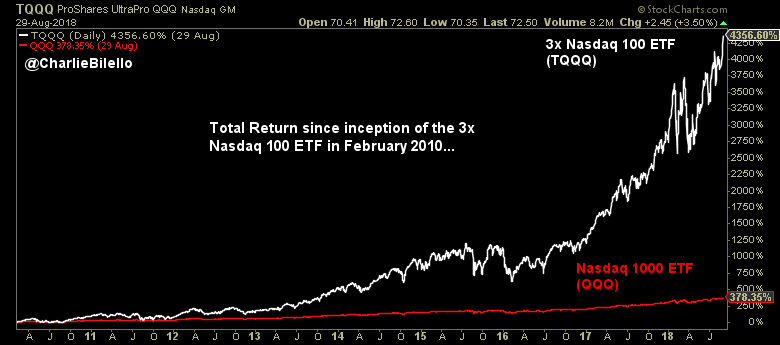

U.S. Companies bought back $217 Billion of their $1.3bn in overseas cash in the first quarter helping fuel a record $189 billion in stock buybacks. More are expected throughout the year. Even Warren Buffett is getting deeper into the game. Has this

August 30, 2018