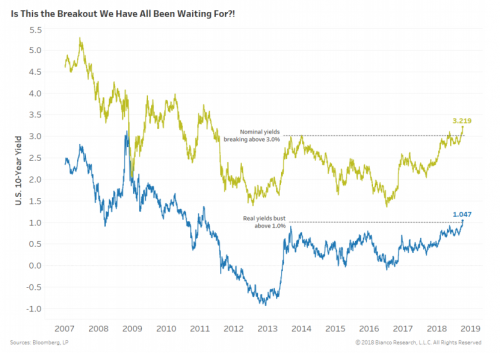

The 10-year Treasury rate has broken out.In less than two months, it has jumped 44 basis points.Equities are selling off.But how sustainable is the rise in these yields, given the leverage in the system? Chart 1 is causing a lot

October 11, 2018

This morning, renowned economist Nouriel Roubini and CoinCenter director of research Peter Van Valkenburg testified before the U.S. Senate Committee to discuss the cryptocurrency and blockchain ecosystem. “Doctor Doom” rattled his grievances with crypto, calling it “the mother or father of all scams and