The biotech sector is offering valuations so cheap right now that in some cases you can buy shares in a company for less than the cash they have in the bank. Sentiment won’t stay this low forever, and when it turns these three stocks will rally back to their former highs.

It has been an absolute brutal six months for biotech investors. The sector is in its deepest funk since the financial crisis and is now down some 35% to 40% from its previous peak in July. Small cap stocks have performed even worse with many down 50% to 75% simply on the shift of sentiment on the sector to “risk off” mode. Small cap stocks that sold for $10.00 a share in summer are going for $2.00 or $3.00 a share. However, the sector seems to be stabilizing over the past week and has rallied more than five percent off its recent lows. Large cap biotech stocks have held up well over the past month and, hopefully, that will still start to spread to smaller and mid-tier plays in the near future.

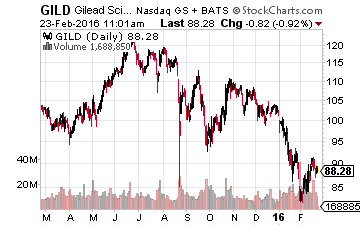

I have been slowly deploying “dry powder” into this sector on every dip in the overall market in 2016. Most of those new funds have been targeted at the big biotech names that are trading at their lowest valuations since 2011. No large biotech company is cheaper or less respected than Gilead Sciences, Inc. (NASDAQ: GILD). This company has morphed into the Rodney Dangerfield of large cap growth stocks despite sextupling earnings from FY2013 to FY2015. The driver of that earnings growth is the runaway success of its two blockbuster hepatitis C drugs Sovaldi and Harvoni which did over $19 billion in sales in 2015.

Despite this growth, the stock sells at just seven times earnings and provides a two percent dividend yield to boot. Harvoni was approved for two new indications of HCV just last week. The company should see growth for its HCV franchise in Europe and Japan this year even if the United States sees some minor declines as some of the sickest hepatitis C patients have now been treated. Investors are overly concerned about potential competition in the hepatitis C space and are giving Gilead no credit for its large and evolving pipeline.

Leave A Comment