Monday, March 7

Tuesday, March 8

Wednesday, March 9

Thursday, March 10

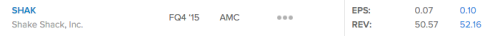

Shake Shack (SHAK)

Consumer Discretionary – Hotels, Restaurants & Leisure | Reports March 7, after the close.

The Estimize community is looking for EPS of $0.09 and revenue of $51.97 million, 2 cents higher than Wall Street on the bottom-line, and around $1.5 million above on the top-line. However, our Select Consensus, which more heavily weights historically accurate analysts and recent estimates, is expecting a greater beat of 3 cents. Shake Shack is seeing favorable revision activity of late with bottom line estimates soaring 24% in the past 3 months. Compared with the same period last year, this predicts a 1010% increase in earnings while sales are looking to increase by 49%. In its relatively short existence as a publicly traded company, the burger vendor has beaten both the Estimize and Wall Street estimates in 100% of its reported quarters.

What to Watch: Shake Shack’s first year as a publicly traded company has been volatile. After shares sold for $21 in its IPO, they soared all the way to $95 in May 2015 only to fall back to $40, where they are today. Revenues are expected to continue their upward trajectory as the company debuts new stores and menu items. This year the burger chain opened 12 new domestic stores, 2 in Q4, and expects to open 14 more in fiscal 2016. Last quarter, Shake Shack reported a 67.4% increase in total revenue from the year prior thanks to 4 new stores and a 17.1% increase in same store sales. Average weekly sales for domestic restaurants also rose 9.6%, primarily due to robust traffic growth, increased menu prices, and a strategic shift in its sales mix. This quarter, the burger joint should benefit from its newest menu item, the Chick’n Shack, which has been received with rave reviews. As the price of beef is now greater than chicken, the newest sandwich should help offset the pressure that burger sales have put on margins. With brand equity comparable to that of a larger company, Shake Shack remains well positioned for continued success.

Leave A Comment