While everyone likes to point the finger at Amazon, the growing retail apocalypse in America can’t be tied to just one catalyst. Certainly, there is no doubt that Amazon is taking a toll on brick-and-mortar retailers but massive excess capacity, perpetually over-levered capital structures and a constant lack of capital investment have undoubtedly helped accelerate the decline.

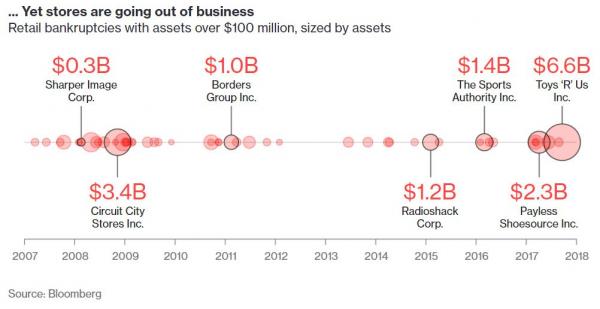

As Bloomberg points out today, up until this year, struggling retailers have largely been able to avoid bankruptcy by refinancing to buy more time. Alas, as evidenced by the Toys “R” Us bankruptcy, investor demand for retail debt has waned of late resulting in a whole slew of recent retail failures.

Meanwhile, investor distaste for retail debt comes just as the industry faces a massive wave of maturities over the next five years.

Making matters more difficult is the explosive amount of risky debt owed by retail coming due over the next five years. Several companies are like teen-jewelry chain Claire’s Stores Inc., a 2007 leveraged buyout owned by private-equity firm Apollo Global Management LLC, which has $2 billion in borrowings starting to mature in 2019 and still has 1,600 stores in North America.

Just $100 million of high-yield retail borrowings were set to mature this year, but that will increase to $1.9 billion in 2018, according to Fitch Ratings Inc. And from 2019 to 2025, it will balloon to an annual average of almost $5 billion. The amount of retail debt considered risky is also rising. Over the past year, high-yield bonds outstanding gained 20 percent, to $35 billion, and the industry’s leveraged loans are up 15 percent, to $152 billion, according to Bloomberg data.

Even worse, this will hit as a record $1 trillion in high-yield debt for all industries comes due over the next five years, according to Moody’s. The surge in demand for refinancing is also likely to come just as credit markets tighten and become much less accommodating to distressed borrowers.

Leave A Comment