AT40 = 52.9% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 55.9% of stocks are trading above their respective 200DMAs

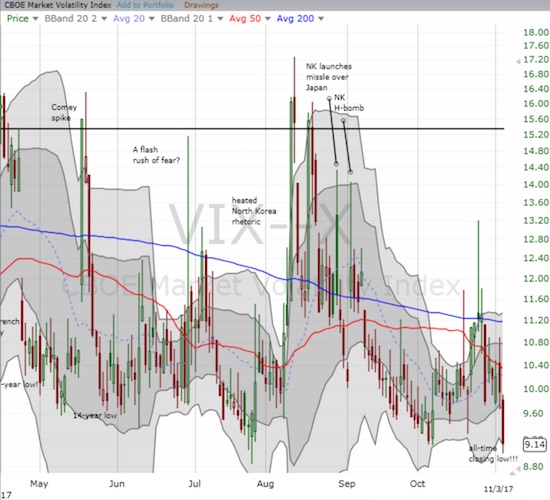

VIX = 9.1 (a new all-time low!)

Short-term Trading Call: cautiously bullish

Commentary

A week ago, I complained that AT40 (T2108), the percentage of stocks trading above their 40-day moving averages (DMAs), barely budged relative to the big move in the S&P 500 (SPY). I was looking for the week to bring a broadening of the rally and an assuring confirmation of the bullishness in the indices. Not only did the market fail to deliver, but the rally actually narrowed further. The S&P 500 ended the week at another all-time high on the heels of a strong response to Apple (AAPL) earnings. The index gained 0.3% on the day. The volatility index (VIX) plunged again, this time to another all-time low, and lost 8.0%. Yet, AT40 dropped to a new 6-week low at 52.9%. AT40 lost a little over 6 percentage points for the week.

The S&P 500 (SPY) continued its bullish trip up its upper-Bollinger Band (BB) channel and finished the week at a new all-time high.

For the second week in a row, the volatility index closed out trading with a large drop. This time the VIX lost 8.0% for the day and hit a new all-time low (data available to 1990).

The divergence in behavior is bearish but far from confirmed as bearish. Just like the last episode of divergence, I am not trying to time the next pullback but instead preparing for a new buy-the-dip opportunity. The last dip that resolved the last bearish divergence was oh-so brief, and I expect more of the same for the next dip.

STOCK CHART REVIEWS

Apple

Almost enough said with AAPL’s chart. AAPL surged and gapped up 2.6% to a new all-time high after reporting earnings that pleased the market. This move is all the more impressive given AAPL skyrocketed into earnings. It looked like a move set up to disappoint.

Leave A Comment