Since we are this week hypocritically obsessing over monetary policy, particularly the federal funds rate end of it, it’s as good a time as any to review the full history of 21st century “conundrum.” Janet Yellen’s Fed has run itself afoul of the bond market, just as Alan Greenspan’s Fed did in the middle 2000’s. But that latter example wasn’t truly the first conundrum for monetary policy. There remain a great many questions (in the mainstream, anyway) about the dot-coms.

If we define conundrum more broadly as I believe more appropriate, then it’s not just about UST yields long or short. It is instead the lack of (monetary) effect through federal funds rate management. In the early 2000’s this was apparent in a whole range of factors – starting with the stock market.

It had become conventional trading wisdom that, under Alan Greenspan, you don’t fight the Fed. He was the “maestro” who at his whim sat enormous monetary power. This idea of the so-called Greenspan put was born sometime in 1998 after the LTCM debacle, a fiasco that nonetheless seemed to validate the premise.

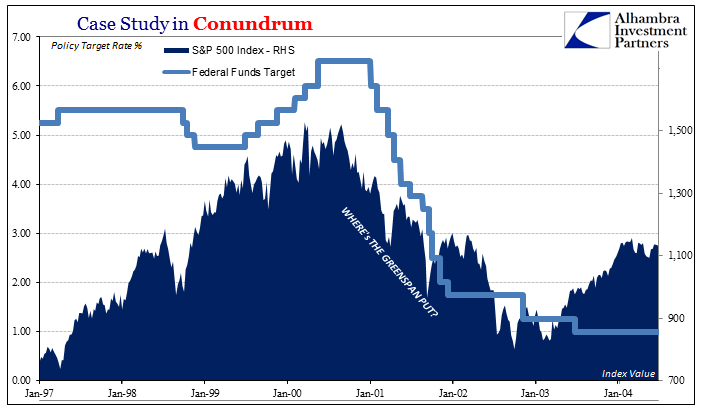

The dot-com bust, however, pushed stocks very sharply lower over an unusually lengthy period of time, taking almost three years to fully complete. During that time, the Fed was not at all idle (as you can plainly see above). In less than a year, Greenspan had reduced the federal funds target from 6.50% down all the way to 1.75%. While the rationalization for its actions was largely economic in nature, there can be no denying that under a discretionary policy regime the FOMC heavily considered the stock market.

That was supposed to be massive “stimulus” and “accommodation”, that which no stock investor should or could ignore. And yet, it clearly had no effect. The dot-com bust went on further despite what in mainstream tradition was a change to tremendously “loose” policy. Greenspan had unleashed the might of his put, and stocks tanked anyway.

Leave A Comment