Photo credit: Yahoo Inc via Visualhunt.com / CC BY

2015 was a tough year for Yahoo and its Chief Executive, Marissa Meyer.

News hit yesterday that the multimedia firm would explore strategic options. According to the press release, these options would include the company doubling down on its existing media properties, like Yahoo Finance, and jettisoning other business line that aren’t core to the business.

Analysts aren’t convinced of the plan, saying it kind of felt that Meyer and the BOD both wanted different things. Eric Jackson, an activist investor lobbying for change at Yahoo, said that the plan was essentially just trying to “split the baby”: the firm will keep trying to do its reverse spin plan (something he called, “not credible”) and at the same time, pursue other alternatives.

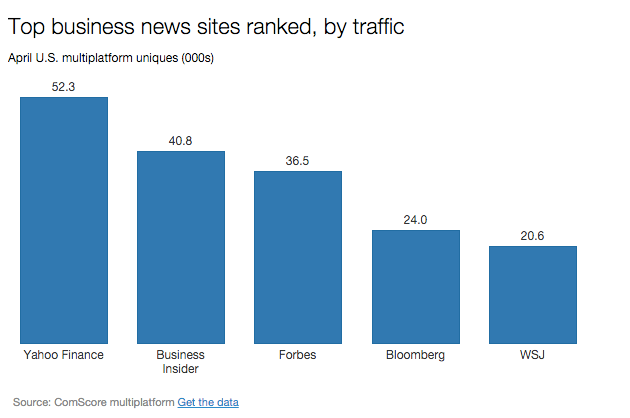

Lost in the mix of all this discussion is Yahoo Finance, still after all these years, one of the largest financial websites. According to analysis by Digiday, though its peers are making major headway, Yahoo Finance in still at the top of the pecking order in most traffic metrics — its 52.3m monthly pageviews in April 2015 were followed most closely by the 40.8m produced by Business Insider. Same for video: Yahoo Finance’s 11.5m eclipsed the desktop video views on Forbes, Bloomberg, and CNBC. With similar viewer demographics shared by the top finance sites, by all accounts, Yahoo Finance is a valuable property.

But talk about Yahoo putting itself up for sale begs the question: what’s to be of Yahoo Finance? In spite of all the tumult and the chaos surrounding Yahoo, its finance property is still one of the largest financial and business websites in the world.

So, who would be interested in buying Yahoo Finance? Tradestreaming produced the following list of suspects:

Leave A Comment