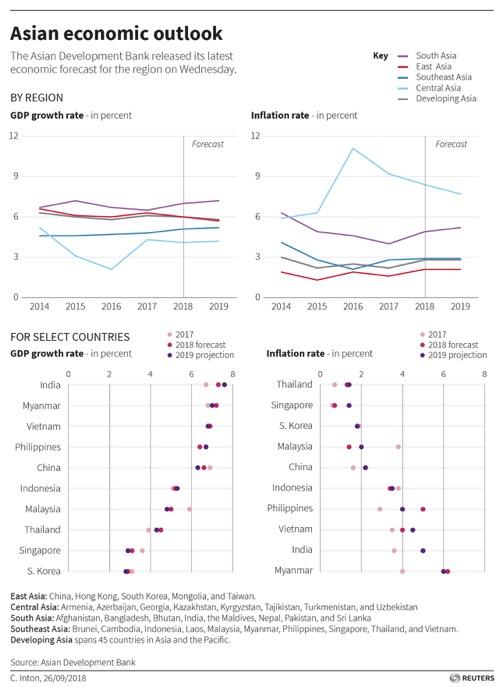

The Asian Development Bank (ADB) warned on Wednesday that growth prospects for Asia next year could slow substantially as the US-China trade war disrupts multinational corporations’ supply chains, inflicting damage on the region’s export-reliant economies.

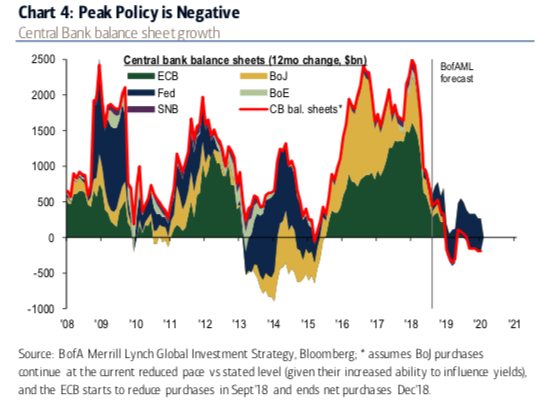

Peak quantitative easing policies have been realized; central bank asset purchases $1.6tn in 2016, $2.3tn in 2017, $0.3tn in 2018, and will decline $0.2tn in 2019. It is late-cycle, and the Federal Reserve is tightening, which explains why global stocks are down YTD ex. US tech. Meanwhile, global liquidity is rapidly shrinking, and that has become a significant concern for Asian business activity by pushing up borrowing costs, while capital outflows are also a risk.

Reuters said the Manila-based institution kept its 2018 economic growth forecast for the region unchanged at 6.0% in an update of its Asian Development Outlook. But slashed next year’s projection to 5.8% from 5.9%.

“Downside risks to the outlook are intensifying”, said ADB Chief Economist Yasuyuki Sawada, pointing to the potential impact of US-China trade tensions on regional supply chains and the risk of sudden capital outflows if the Federal Reserve continues hiking interest rates.

The ADB’s growth cut to 5.8% estimate for 2019 would be the slowest for the region since the Dotcom bust (2001) when it expanded 4.9%. The report covers a total of 45 countries in the Asia-Pacific region.

Additionally, Reuters said ADB’s revised outlook for 2019 had not factored in President Trump’s recently implemented tariffs on $200 billion worth of Chinese goods imposed on Monday.

The domestic economy in China “seems to be quite robust and supporting 6.6% growth this year”, Sawada told the press. “But admittedly we don’t know (how) the further escalation of the trade dispute may directly affect consumer sentiment.”

Beijing fixed its 2018 growth target to 6.5%, similar to 2017, which it beat by expanding at 6.9%. Despite the trade war, Chinese authorities have stayed the course for 2018 growth target, as new easing measures have been introduced to prevent an already cooling economy.

Leave A Comment