Here’s something to think about (excerpted from my latest over at DealBreaker called “Amazon Is Cheap At Any Price, Say Carnivorous Animals“):

Amazon is the poster child for a consensus view about “world-changing” companies. That consensus is basically that no price is too high when it comes to staking your claim on a share (figuratively and literally) of the future.

“I’d pay anything for a piece of a company that’s going to change the world” isn’t really a “thesis.” It’s just common sense. If you know that something or someone is going to change the world, then the only way you’re not bullish on that something or someone is if you’re bearish on human progress, and I’m not sure “neanderthal nostalgia” is really a thing.

The question then, becomes this: can you see the future? And if you can’t, then it would be wise to avoid overpaying for companies that you imagine are going to shape a future you can’t see. Doesn’t mean you shouldn’t own them – you should own them. But you shouldn’t own them at any price. More in the linked post above.

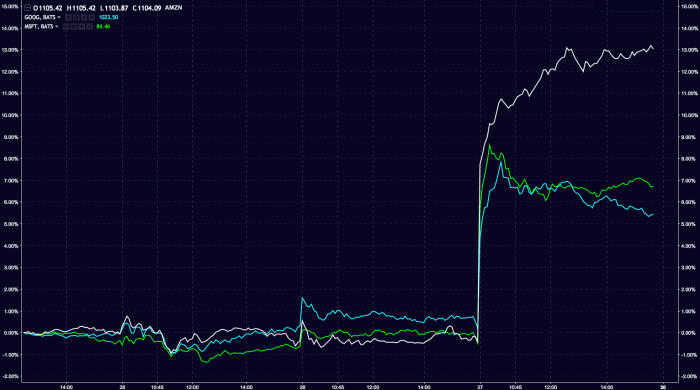

With that said, it was one helluva good day for the “future” where “the future” means today’s tech behemoths.

Obviously, that’s the reaction to Thursday’s earnings and it was all that mattered on Friday. In fact, as Bloomberg notes, the Nasdaq 100 had its best day in eight years relative to the broader market:

Best day for the Nasdaq Comp. since the election:

CNBC reminds you that Amazon just added one whole FedEx in a single day.

Massive day for FANG in general – just as things were looking dicey:

Note the timestamp on this tweet (i.e. just as everyone was laughing at iPhone 8):

Leave A Comment