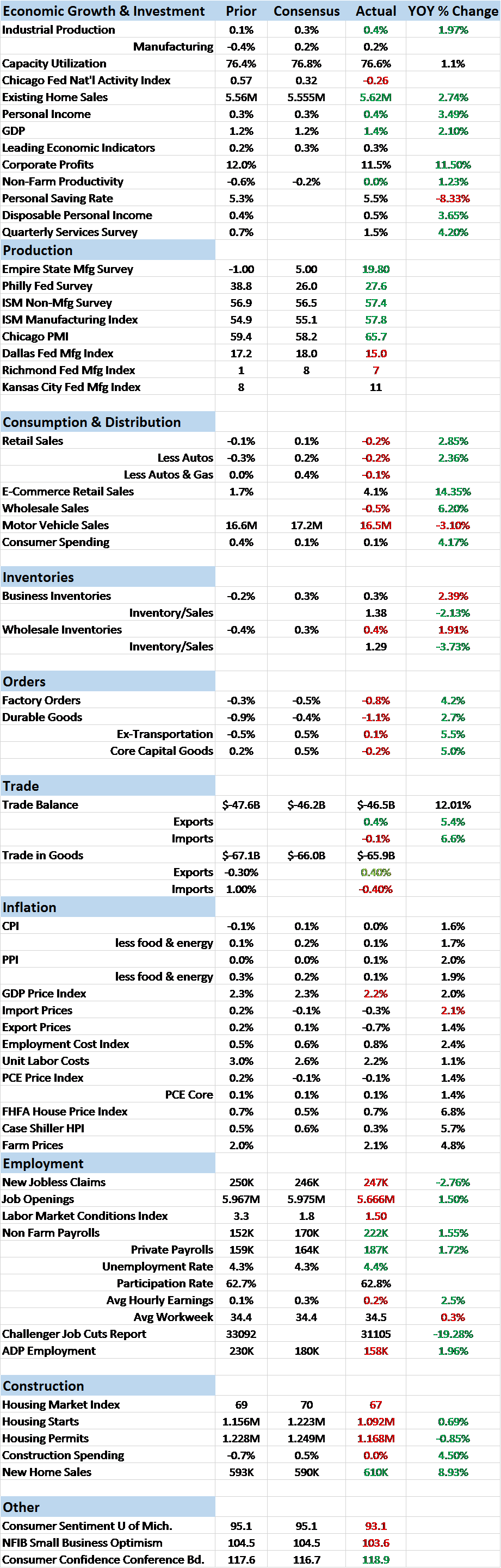

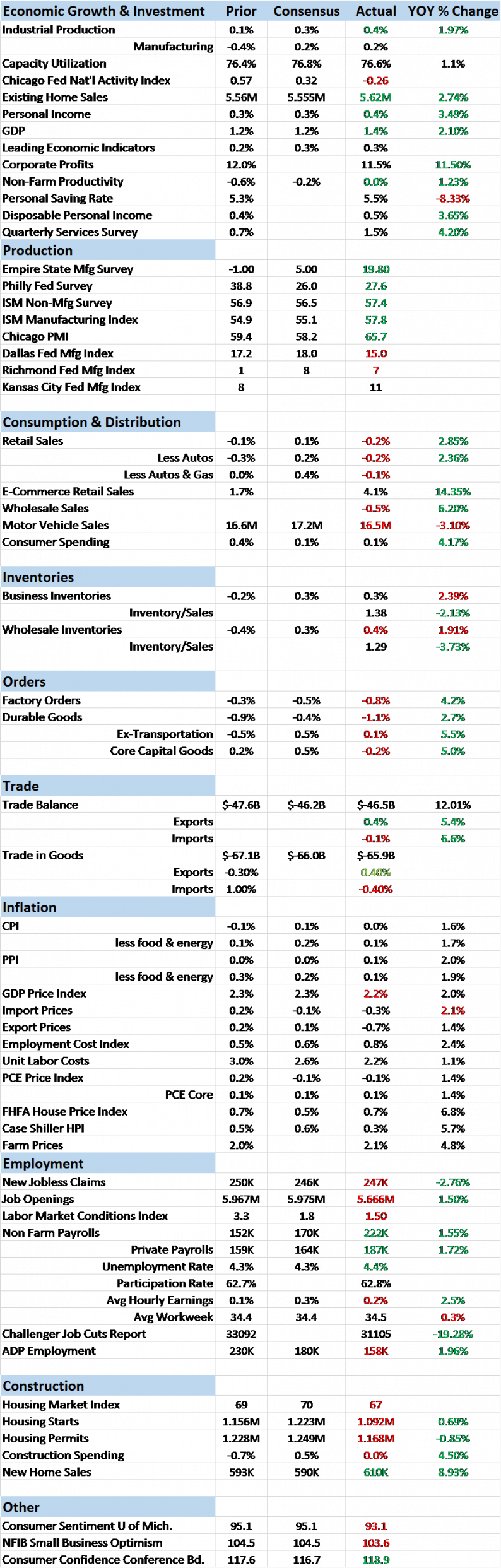

The majority of the economic reports over the last two weeks have been disappointing, less than the consensus expectations. The minor rebound in activity we’ve been tracking since last summer appears to have stalled. Retail sales continue to disappoint and inventory/sales ratios are once again rising – from already elevated levels. Even the positive reports were clouded by negative undertones. So far though our market based indicators have not deteriorated sufficiently to create any urgency when it comes to recession.

The US economy started to rebound some last summer, something we noted through our observation of market based indicators. Interest rates started moving higher, the yield curve steepened and real interest rates rose, all before anyone had an inkling that Donald Trump would be moving into the Oval Office. The election did accelerate those trends but they were really based on an inflection in real economic activity that preceded the election. Many of our market based indicators peaked around the beginning of the year but some continued to show high expectations for the US economy well into the new year. The 10 year Treasury note yield, for instance, peaked in mid-December but didn’t really break down until spring.

As you can see, we have seen a recent rebound in yields, based primarily on optimism about the global economy. There seems to be some expectation that better growth outside the US will also be positive for growth within our own borders. There is probably some truth to that but you’d have a hard time proving it by the high frequency economic data released recently.

The Factory Orders report confirmed the durable goods report of the previous week but also showed that non-durables fell as well. Some of that was due to falling prices for gas and other fuels but not all. What tells you a lot more about the state of the US economy is that overall Factory orders are running at around the same level as a decade ago. And the rebound from last summer is already fading, the recovery from the 2015/16 slowdown failing at subdued levels.

The ISM manufacturing survey was better than expected as was the non-manufacturing version. But we’ve been seeing that for some time now and as yet the optimism voiced in those reports has failed to show up in the official numbers. Other measures of sentiment are not doing as well. The NFIB survey of small businesses was less than expected, mostly due to disappointment on the lack of progress on healthcare reform. The U of Michigan consumer sentiment survey was also disappointing as expectations regarding the future are waning.

Leave A Comment