The mainstream narrative as it relates to Chinese money is “tightening.” Having survived the economic downturn last year, we are to believe that the PBOC is once again on bubble duty. They raised their reverse repo rates, considered to be their policy benchmarks, three times up to mid-March. The central bank also increased the rate on its Medium Term Lending Facility (MLF) which has been a main source of RMB liquidity but for reasons that don’t conform to the narrative.

The PBOC balance sheet for the month of March 2017 shows us the impacts of both its currency policy as well as at least some outward appearance of tightening. There was very little change in the monetary base, which for China means forex “reserves.” It is actually consistent with CNY being unusually stable well past its “ticking clock”, meaning that the PBOC is doing other things that don’t show up here. Those “other” transactions typically result in a tightening of RMB relationships.

As a purely monetary matter, bank reserves in March increased as a result of winding down holiday measures (including a much lower government balance). The post-2015 trajectory for bank reserves remains, which suggests a neutral policy rather than tight or loose.

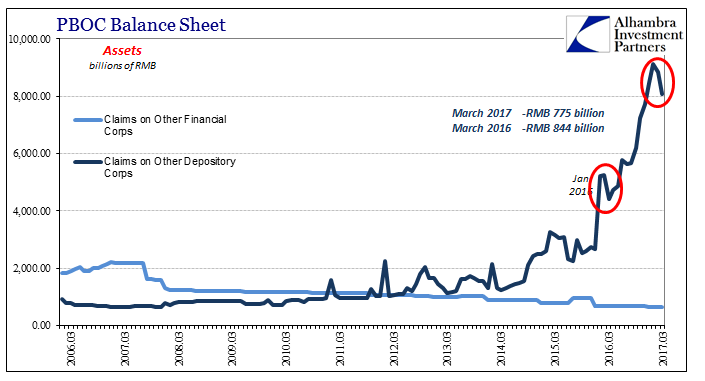

The only real drain on the asset side, and therefore an intentional monetary act, was for Claims on Other Depository Institutions. This has been the area where rather than exhibit a negative monetary stance the PBOC has been in RMB overdrive, acting hugely acquiescent instead. Though the balance fell for March, that wasn’t unusual given typical seasonality surrounding the offside of the New Year holiday. The decline on this line was actually less than it was in March 2016, suggesting that the PBOC left some additional RMB in the system.

While overall Claims had declined in normal seasonality, the primary source of expansion the past three years, the MLF, increased significantly. The PBOC reported a total MLF balance of more than RMB 4 trillion for the first time last month. It was an increase of RMB 303 billion, double the rate of expansion in February. In just the past five months going back to (and including) November, MLF usage has nearly doubled, rising an astounding RMB 1.95 trillion. It is that short amount of time which is exactly the period this “tightening” policy has supposedly been in place according to the narrative.

Leave A Comment