Brexit impact on value of British pound sterling: With a potential “Brexit” approaching, Goldman Sachs says regardless of the outcome the British pound sterling will be a “fashionable” and “actionable” currency in 2016. This isn’t the first time this has happened, and a price pattern has emerged over time, with such a “fashionable” event occurring five times since the 2008 financial crisis.

Brexit impact: Two price probability paths for British pound sterling

There are two probability paths for the pound, with a Brexit impact weighing heavy: either the U.K. exits the European Union or it remains. Both of these fundamental developments will take the currency value on two different paths. But eventually the result could be positive for the British currency.

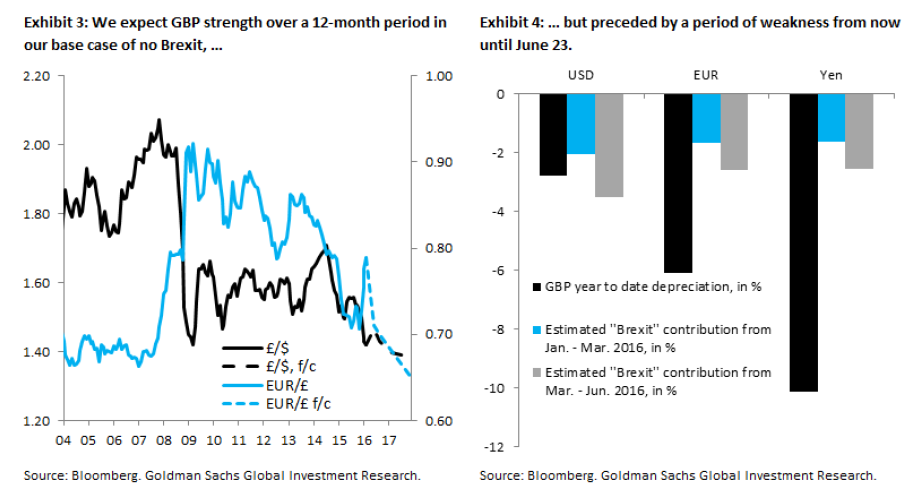

Goldman analysts Silvia Ardagna, Robin Brooks and Michael Cahill note that after a 3%-5% cable downside in the run-up to the referendum, a reversal could occur. “We expect approximately a 4% appreciation and forecast GBP/$ at 1.40 in 12 months.” Arriving at this point, however, will not likely occur in a straight line.

The report acknowledged that forecasting the exit of Britain from the European Union is a difficult proposition, but ultimately favored the United Kingdom staying in the EU.

Probability path analysis with and without a Brexit

Without covering only one side of the probability path discussion, the report assumed that leading up to the June 23rd decision they “expect a period of Sterling weakness.” But what happens after this weakness is dependent on the outcome. “If Brexit does not occur, as we expect, the FX market will have to catch up to price in a Bank of England tightening cycle that could begin earlier and progress faster than discounted in the forwards,” they wrote.

Goldman’s base case is that the U.K. remains in the European Union, and this is likely to be followed by strength in the British currency. If, however, the U.K. leaves the European Union an initial period of depreciation could occur.

Leave A Comment