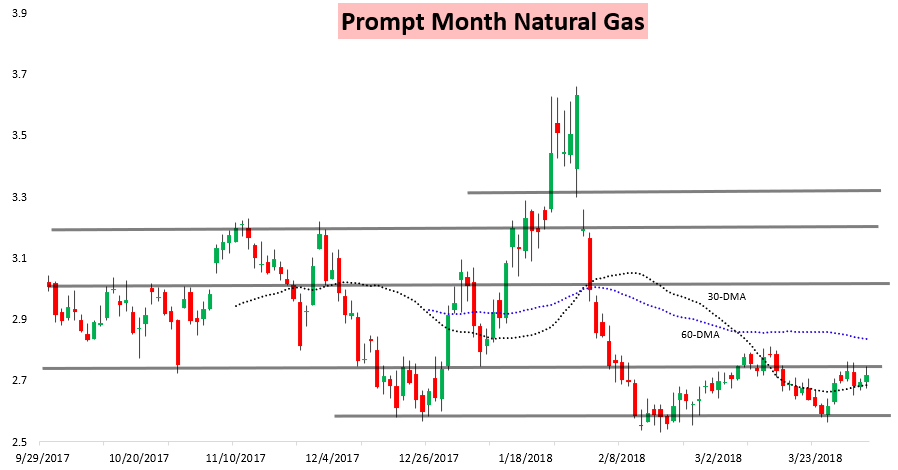

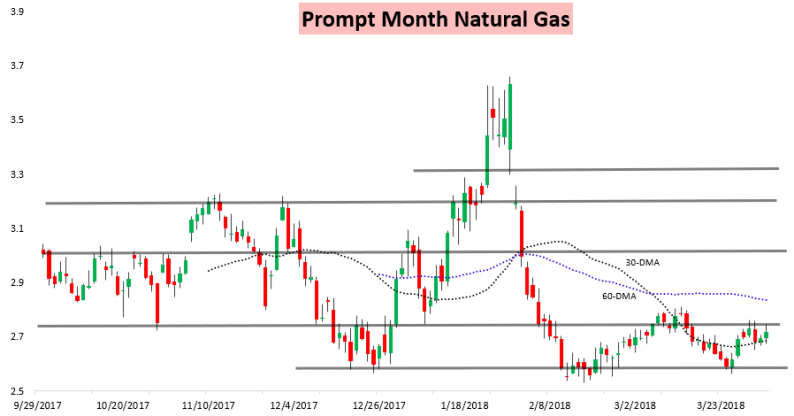

Prompt month natural gas prices settled up less than a percent today after spiking earlier this morning.

This came as Henry Hub cash prices ticked up higher over prompt on the day as well.

In our Morning Update we had warned subscribers of exactly that, explaining that cash strength would put $2.72 and even $2.75 in play. Prices ended up peaking at $2.746, just unable to test that $2.75 resistance level.

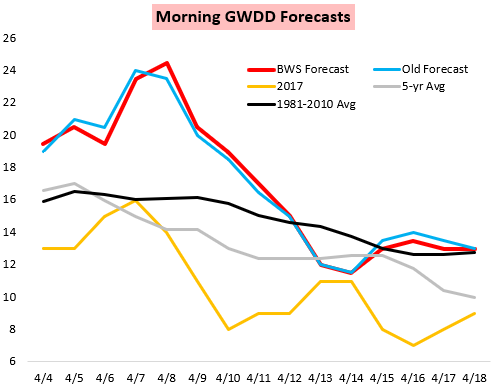

Cash prices were aided by short-term cold that is expected to be very impressive. Our Morning Update called for demand peaking on the 8th that would be significantly above average.

Prices pulled back into the settle but gains were clearly strongest at the front of the strip.

This comes ahead of an EIA print that many expect to be rather unimpressive. Last week we correctly predicted that risk was to the bearish side with the EIA print, sending out a note as early as last Tuesday that risk was skewed bearish with the print. Sure enough, prices pulled back after the print underwhelmed.

Our Afternoon Update today broke down today’s price action, explaining where we saw risk into tomorrow’s EIA print. Tomorrow’s Morning Update will then outline how we expect the print to impact prices, as well as what our final estimate is. Immediately after the print we will release our EIA Rapid Release, looking at how the print fits our balance expectations and modeling and how prices should trend into the end of the day.

Leave A Comment