Well markets are rocking from London to Hong Kong on Tuesday as the world takes its cues from the blockbuster rally U.S. stocks staged on Monday.

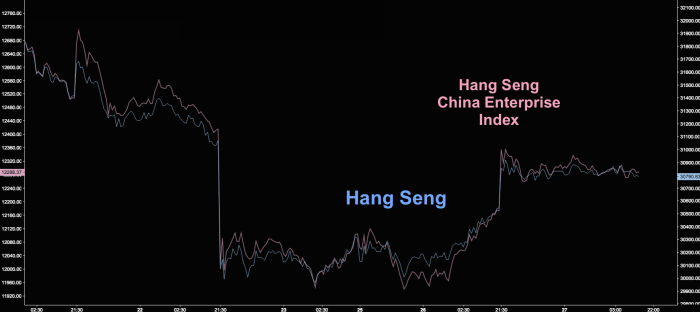

Hong Kong shares were up nicely and H-shares followed suit, recouping some of last week’s steep losses:

On the mainland, the SHCOMP posted its first gain in five sessions and the ChiNext soared some 3.6% – the small-cap gauge is well on its way to recouping last week’s decline:

In Japan equities surged, with the Nikkei posting its second best day of 2018, up more than 2.5%:

Helping matters for Japanese stocks is the yen, which fell against most of its Group-of-10 peers overnight. USD/JPY continues to climb back from the brink (last week it looked like the bottom might fall out entirely, forcing Japan to intervene):

European stocks are similarly pleased, rising across the board after falling into a correction on Monday – the euro is coming off the highs this morning after rising strongly to start the week (the surging currency was part of the problem for European stocks yesterday).

But none of this is enough to impress Bloomberg’s Mark Cudmore who, despite a generally upbeat disposition, turned bearish in late January (good timing, Mark).

This morning, he’s made a bullet point list of reasons why stocks haven’t bottomed yet. You can find it below.

Via Bloomberg

Equities haven’t bottomed just yet.

Leave A Comment