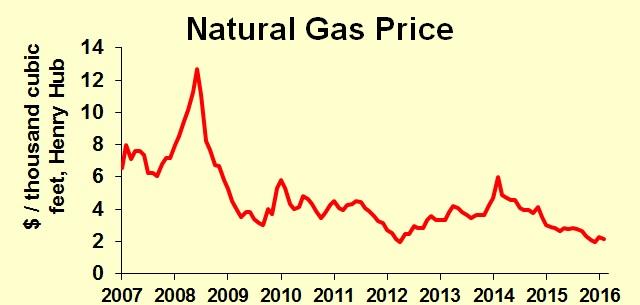

In 2008, Cheniere Energy (LNG) of Houston spent two billion dollars building a facility to import liquefied natural gas. Common projections at the time showed declining North American production of oil and natural gas, helping the price of natural gas in the United States to hit $14 per thousand cubic feet.

Just five years later, Cheniere had imported nothing at all, but was spending $12 billion to build export facilities for LNG. This week they finally began liquefying gas for export, according to press reports.

Natural gas prices dropped from that $14 peak to a recent quote of just two dollars. The cause of the turnaround: a new technology called hydraulic fracturing—“fracking”—as well as other innovations for drilling oil and natural gas wells.

How can a company spend two billion dollars only to learn that technology has reversed the need the firm was trying to exploit? Technological change turns out to be hard to predict. And it can have huge impacts on business.

Some technological change is fairly easy to forecast. For one example, optical character recognition—computers understanding scanned words or handwritten words—gets better every year. It’s no leap of faith to assume this will continue to improve for at least a little longer. However, plenty of change is explosive in magnitude or involves sudden convergence of separate technologies, producing large, unexpected impacts.

Other widely-anticipated technological change never comes at all—I’m still waiting for my flying car and my robotic butler. Thirty years ago I read that ceramics will replace metal in engines. If TV’s Jeopardy answer is “This 50-year-old idea has not developed nearly as far as expected, though it did win a popular game show,” then the question must be, “What is artificial intelligence?”

When your company is planning its future, how can it understand the impact of technology on the business?

Leave A Comment