In the 2015 October edition of the Market Overview, we analyzed the impact of the Chinese slowdown, as well as the stock market crash and the devaluation of yuan, on the gold market. Two years later, it is worth providing investors with an update about the second biggest economy in the world, especially since the 19th National Congress of the Communist Party of China will be held in October.

It will be a key gathering leading to a massive leadership change as five of the seven members of the Politburo Standing Committee, China’s most powerful ruling body, are due to retire. The congress will serve as a test of President Xi Jinping’s power, and who gets promoted may also have significant global impact. Investors expect that the Congress will accelerate implementation of pro-market reforms, but these hopes may be too optimistic, as Xi has already announced the growth target of at least 6.5 percent through at least 2020, which could be hard to achieve while introducing structural reforms.

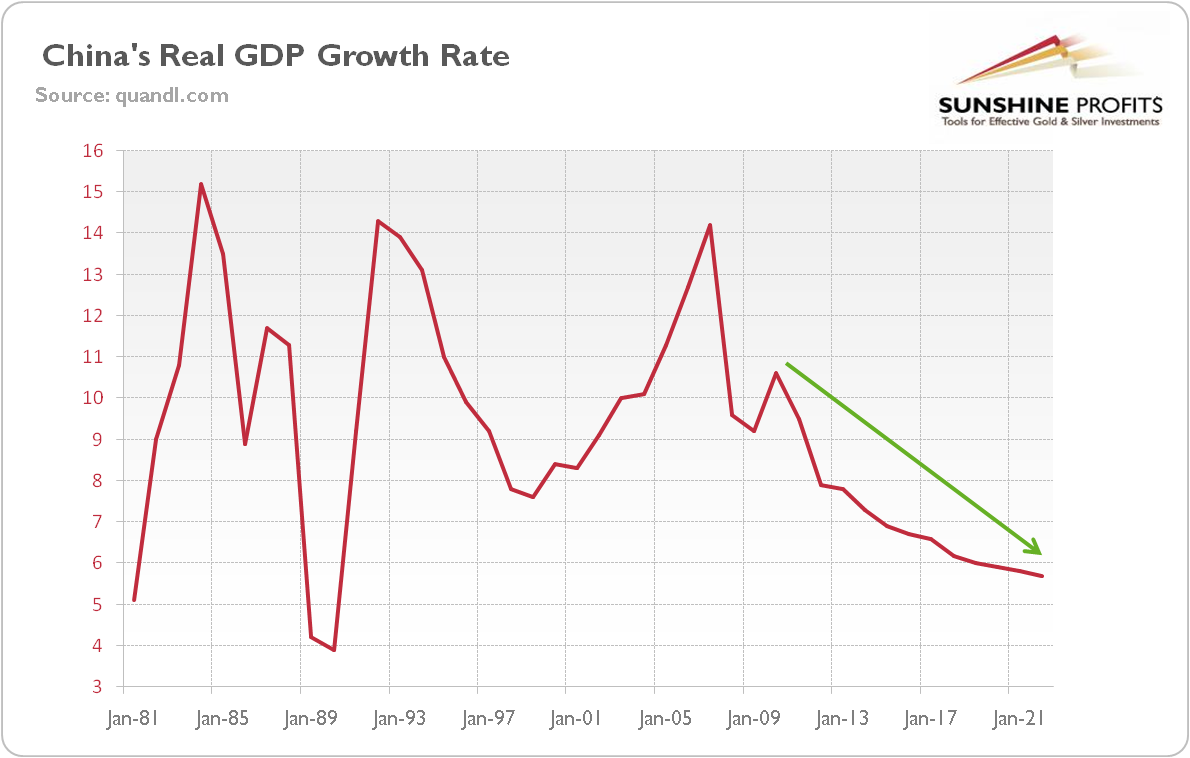

Anyway, the economic stance adopted by the new leaders will be crucial given China’s recent economic slowdown. As one can see in the chart below, the real GDP growth rate declined from double-digit numbers to 6-7 percent.

Chart 1: China’s real GDP growth rate from 1981 to 2022 (numbers for 2017-2022 are IMF’s projections)

Although unpleasant, the deceleration is not necessarily alarming, given the country’s transition from investment-driven growth to consumption. It’s quite normal that over time there are diminishing returns to further investments. And given that growth was based on unsustainable levels of investment, the switch to a more consumption-led model is actually warranted.

This does not mean that there are no grounds for concern. For example, the rise of the shadow banking system, which operates beyond the regulations, is worrisome. Its share of total credit soared from 10 percent in 2006 to 33 percent currently, leading to an excessive risk-taking and unjustified valuations of different assets, especially real estate.

Leave A Comment