The Coca-Cola Company (KO – Free Report) delivered a strong third-quarter 2018, with better-than-expected earnings and sales. This marked the sixth straight quarter of an earnings beat while sales topped estimates for the fifth consecutive quarter. Third-quarter results gained from the effective execution of the company’s strategies to evolve as a consumer-centric total beverage company.

Alongside the introduction of products, the company is focused on lifting and shifting successful brands globally. It also benefited from the acceleration of its sparkling soft drinks category through investment and innovation.

Shares of Coca-Cola increased nearly 1% after solid third-quarter results. Moreover, the stock decreased 1.5% in the last three months, outperforming the industry’s decline of 10.9%.

Q3 in Detail

The company’s third-quarter 2018 comparable earnings were 58 cents per share that surpassed the Zacks Consensus Estimate of 55 cents. The bottom line also improved 14% from the year-ago period, driven by ongoing productivity efforts and disciplined growth strategies. Currency translation negatively impacted earnings by 8%.

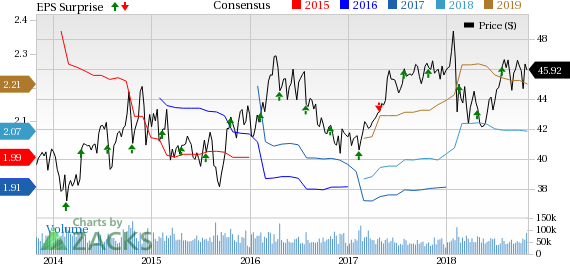

Coca-Cola Company (The) Price, Consensus and EPS Surprise

Coca-Cola Company (The) Price, Consensus and EPS Surprise | Coca-Cola Company (The) Quote

Revenues of $8,245 million beat the Zacks Consensus Estimate of $8,227 million. However, net revenues declined 9% year over year due to 13% adverse effect from the refranchising of company-owned bottling operations. This represented the company’s 14th consecutive quarterly fall.

However, organic revenues grew 6%, aided by concentrate sales improvement of 4% and price/mix growth of 2%.

Volume and Pricing

Coca-Cola’s total unit case volume expanded 2%, boosted by growth in the Coca-Cola Trademark. Further, the company witnessed 2% rise in price/mix, backed by continued strength in the core business.

Category Cluster Performance: Sparkling beverage unit case volume increased 2% (compared with 2% growth in the prior quarter). Juice, dairy, and plant-based beverages witnessed a 3% decline (compared with 2% decrease in the last reported quarter). Water, enhanced water and sports drinks were up 5% (in comparison with 4% growth in Q2), and Tea and Coffee slipped 2% (compared with 1% decline in Q2).

Leave A Comment