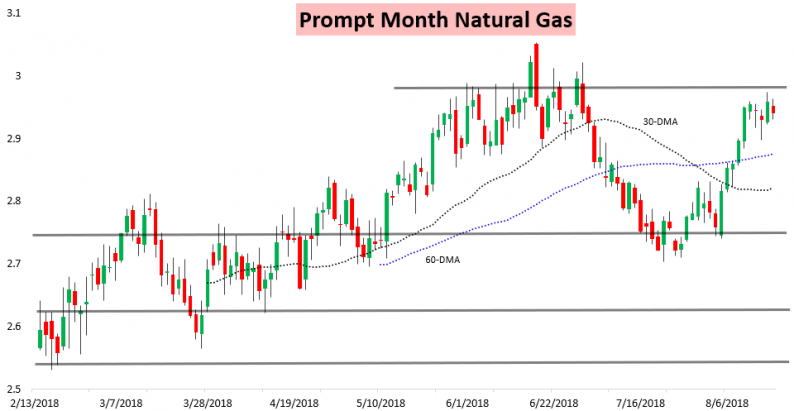

It was a slow day trading the prompt month natural gas contract, with the September contract trading in just a 3.3-cent range through the day. It settled down a bit more than half a percent on the day as forecasts continued to cool in the medium-range.

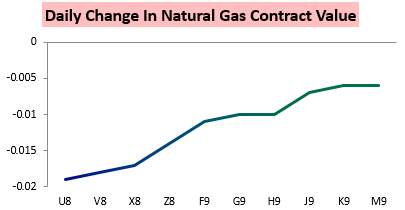

The role of cooler forecasts was readily apparent as the primary decline in prices came at the front of the strip, even as cash prices were strong again today.

The September/November U/X spread got hit solidly on the day and settled at its lowest levels since August 1st.

Today’s decline confirmed our Slightly Bearish sentiment in our Afternoon Update yesterday.

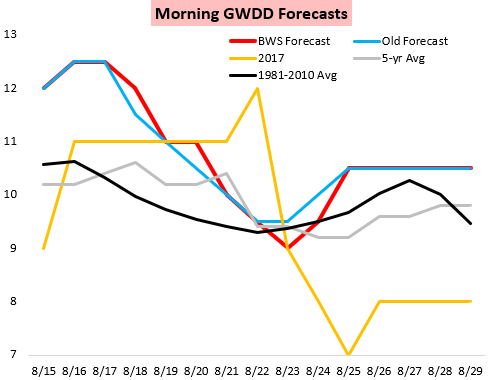

This continued in our Morning Update, where we outlined that due to, “…what should be more firm cash prices again today with heat peaking in the next couple of days…[a] bounce back towards $2.95-$2.96 short-term is a possibility with a firmer strip and weak long-term heat, but risk overall is still a bit lower.” That’s exactly what we saw play out, with prices peaking at $2.963 before falling later in the day. Climate Prediction Center forecasts continued to show significant cool risks in the medium-term in line with expectations too.

This fit with our AM forecast that showed cooling demand peaking in the next couple of days.

Leave A Comment