Safe-haven demand for physical precious metals came in soft through the first half of the year as a rising stock market reinforced investor optimism toward the economy.

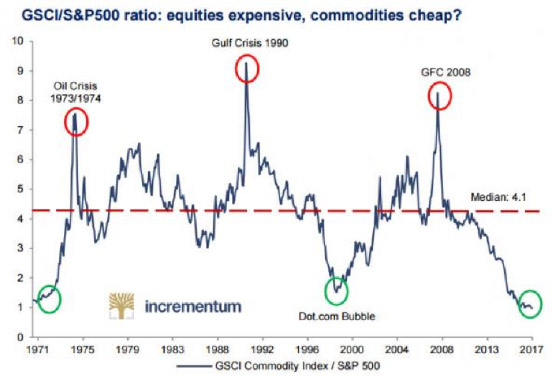

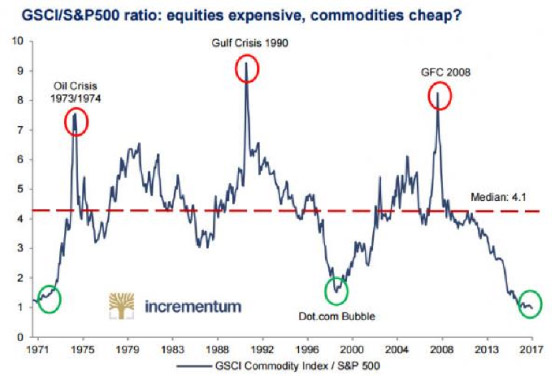

U.S. stocks are expensive by just about every valuation measure you can think of – price/earnings, price/sales, dividend yield, total market capitalization as a percentage of GDP, etc. Even Fed Chair Janet Yellen remarked recently that equity valuations appeared “rich.”

The inverse of the extreme overvaluation in equities is the extreme relative cheapness of hard assets. Commodity indexes entered the summer at generational lows in real terms.

The perception has been that the world is awash in plentiful, cheap oil. Just a few years ago, with oil over $100 per barrel, the headlines blared warnings about peak oil and supply shortages. At major cyclical turning points in commodity markets, the news tends to reinforce whatever trends brought about major highs or lows in prices.

What investors need to keep in mind is that commodity markets are always cyclical in nature. No matter how bullish or bearish the outlook happens to appear at any given time, prices will eventually turn and trend in the opposite direction.

Oil and agricultural commodities perked up as summer officially began. Whether it’s the start of a major cyclical bull market remains to be seen. But the supply and demand fundamentals are setting up bullishly for commodities markets.

Lower Prices Stunt Production & New Shortages Push Up Prices

The cycle for any commodity follows the same basic pattern. When prices are low, production falls. As new supplies diminish, the market tightens and prices move higher. The higher prices incentivize producers to invest in production capacity and increase output.

Eventually, the market becomes oversupplied, prices fall, and the cycle starts all over again.

As a resource investor, it’s important to have some idea of whether you’re investing in a commodity at a time in the cycle when it’s favorable to do so. Gold, for example, tends to be less correlated to swings in the economy than oil and industrial commodities. It responds more to investor fear and flight from paper asset markets.

Leave A Comment