Today, the Bank of England kept its key policy interest rate for the British economy unchanged at the record low 0.25% – but just barely. The three dissents out of eight total votes show how a weak currency and rising inflation are making it harder to keep rates low. The worst case scenario is an inflationary recession, which would topple Theresa May and perhaps set the ground for a change in the UK’s Brexit stance.

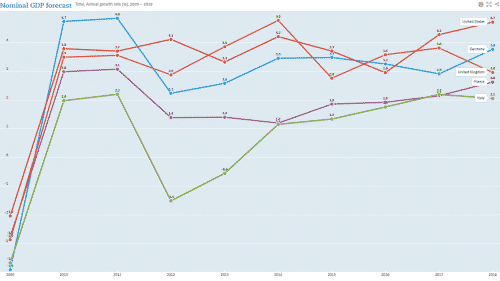

The data: Now, if you look at growth expectations for the UK compared to some of the biggest countries in the world, things don’t look so bad.

Source: OECD

Expected growth for the UK falls into the middle of the pack. And while the UK was the fastest growing country in the world three years ago, its growth rate has not slipped that much, even after the Brexit vote.

But, of course, these are nominal figures, unadjusted for inflation, when you look at inflation as the Pound has fallen after the Brexit vote, things look much more challenging.

If the British economy actually were to grow 3.0% as the OECD projections foresee, you basically have no growth given current levels of inflation. It’s not hard to imagine scenarios where inflation-adjusted GDP declines. And that would be what I would call an inflationary recession – where growth doesn’t decline significantly until you factor in rising inflation.

Let’s remember that we have falling real wages in the UK right now. And this is depressing consumption. On Monday, I mentioned the data from Visa showing real spending had declined year-on-year. Today we also got very poor retail sales numbers out of the UK as well.

The consequences: Politically, I think this is destructive for Theresa May. She has made no fiscal contingencies to deal with economic weakness in the aftermath of the Brexit vote. In fact, she has done just the opposite, running an election campaign in which she abandoned the “no tax rise” pledge, promised continued cuts to social programs, and made a ghastly error in inserting the ‘dementia tax’ into the Conservative manifesto. These were critical mistakes. And it was all very predictable too.

Leave A Comment