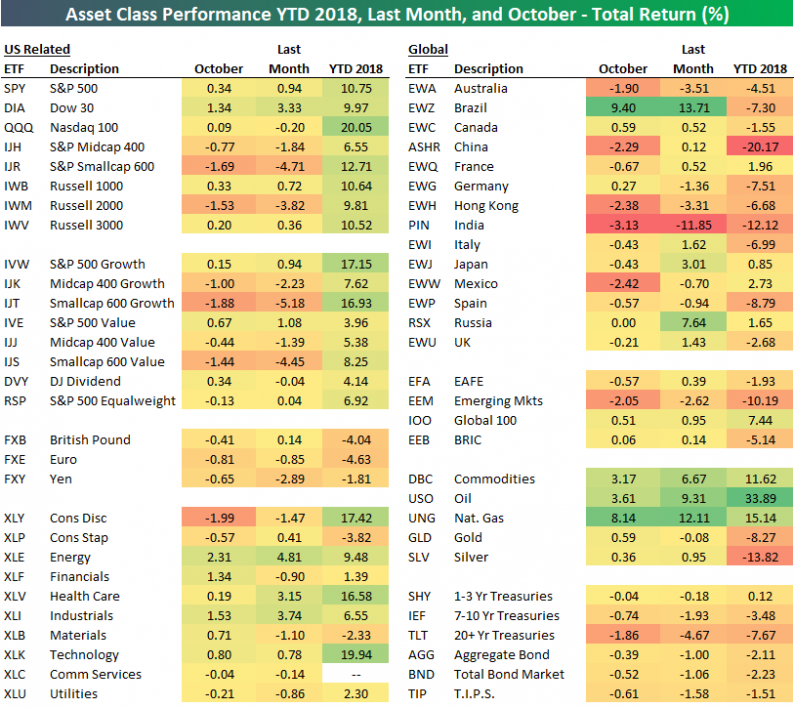

Below is a snapshot of asset class performance to start the month of October. We also include performance over the last month and year-to-date.

The month has gotten off to a pretty strange start, with lots of equity ETFs going in different directions. Small-cap ETFs have gotten hit very hard, while large-caps are in the green. Both consumer sectors are in the red, with Consumer Discretionary (XLY) off by 2% already. On the upside, Energy (XLE), Financials (XLF), and Industrials (XLI) have seen a wave of buying.

Outside of the US, Brazil (EWZ) is already up 9% in October, while India (PIN) is down more than 3%. Prior to September, India had been performing relatively well this year, but an 11.85% drop over the last month has sunk the country deep into the red. China (ASHR), Hong Kong (EWH), and Mexico (EWW) are all down more than 2% this month already as well.

Commodities ETFs are on fire, especially energy-related ones.Oil (USO) is up 3.6% month-to-date, while natural gas (UNG) is up 8%. Finally, Treasury ETFs have fallen quite a bit so far in October as interest rates have broken out higher.

Leave A Comment