Dow futures are up some 80 points this morning after early on Wednesday morning the Senate passed the Tax Reform bill in a party-line vote, and is now set to become law after a follow-up vote in the House and Trump’s signature sometime on Wednesday afternoon. The good news is that the biggest political drama of 2017 will then be over. The bad news is that once the bill becomes law, the market will no longer be able to “price it in” every single day as it has for the past year.

As reported overnight, and as expected, the Senate approved the tax-cut legislation in a 51-48 party-line vote, bringing President Donald Trump to the brink of his first major legislative victory. The bill now moves to the House of Representatives for a final vote Wednesday. With corporate and individual tax rates set to drop, the measures are largely anticipated to add to growth over the next year or two, though they will also swell the budget deficit.

And while S&P 500 futures extended modest gains on the bill news, they have so far fallen short of yesterday’s high, in somewhat tepid reaction to the passage of the U.S. tax bill in the Senate, suggesting there is only so many times an endlessly regurgitated piece of news can be “priced in for the first time.”MSCI’s world equity index was little changed and holding just below record highs hit on Monday.

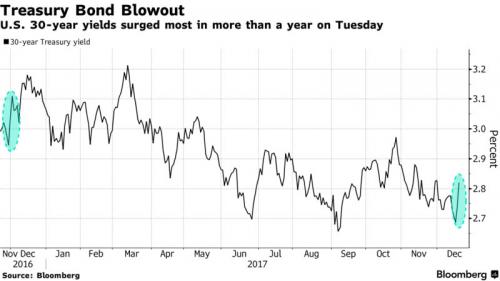

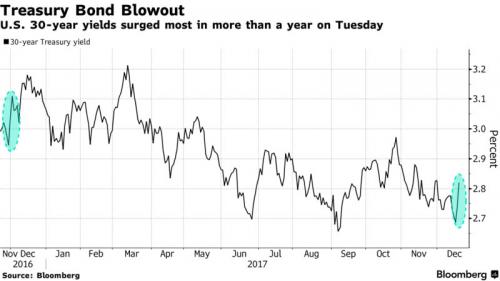

Overnight, European bonds were mixed as U.S. Treasury yields edged lower after yesterday’s jump, sparked by hawkish comments from central bankers…

… and recovered from a brief dip following the Senate tax news, while the U.S. dollar comes under renewed pressure versus its G-10 peers as investors await a second House vote on the bill.

“Last week the reaction of bond markets was one of ambivalence about the likelihood of these measures getting passed,” said Michael Hewson, a chief market analyst at CMC Markets in London. “However, U.S. yields have jumped sharply higher in the last two days as the prospect of higher inflation and growth prompted some positioning adjustments in anticipation that the measures if passed, could prompt conditions that might see rates have to rise faster than expected next year.”

In global equities, the feel-good factor from U.S. tax reform faded in Europe on Wednesday, with stocks struggling for traction after a mixed session in Asia and the dollar trading little changed.

Most European stocks weakened, led by Spain ahead of a regional Catalan election on Thursday. Basic resources sector among the biggest gainers as industrial metals rebound in London trading. German debt again leads core euro-area government bonds lower, with notable underperformance in the front end driving yield curve bear-flattening.

Europe’s Stoxx 600 Index drifted little changed, down fractionally, with Spanish equities underperforming before tomorrow’s Catalan poll. Utilities and telecoms dropped, while miners gained as the Bloomberg Commodity Index advanced for a sixth day. Steinhoff shares crashed 30% after the furniture retailer said lenders have started to cut off support as reported yesterday. RWE leads Germany’s DAX Index higher after the departure of Innogy’s CEO sparked speculation around the company’s strategy

Earlier, Japan’s Topix index closed at its highest level since November 1991, while stocks in Hong Kong and China declined. ASX 200 (+0.1%) and Nikkei 225 (+0.1%) eventually traded positive on what was a choppy session with corporate scandals clouding over Japan including the maglev bid collusion, while Subaru was the worst performer after allegations it may have falsified mileage data. Chinese stock markets fared no better as both Hang Seng (-0.1%) and Shanghai Comp. (-0.3%) traded with a lackluster tone, amid mild profit taking from recent gains. Finally, 10yr JGBs were flat as prices failed to benefit from the sombre risk tone or Rinban announcement valued at JPY 840bln in maturities across the curve, as the BoJ also kick-started its 2-day policy meeting today.

The euro got a lift from higher eurozone rates, gaining 0.5 percent on Tuesday, when central bank governors of Estonia, Slovakia, and Germany all discussed the need to shift the debate from bond purchases to other tools such as interest rates.

“That’s re-igniting the debate about ECB tightening, so despite the outlook for the U.S. tax bill passage, euro-dollar is strong right now,” Masafumi Yamamoto, chief currency strategist for Mizuho Securities in Tokyo.

Against a basket of six rival currencies, the dollar was a touch lower on the day at 93.418. The greenback edged down 0.2 percent to 113.11 yen, while the euro was a touch firmer at $1.1850.

Elsewhere, U.S. crude oil futures extended gains, helped by a North Sea pipeline outage, OPEC-led supply cuts and expectations that U.S. crude inventories had fallen for a fifth week. WTI and Brent crude futures remain supported by the larger than expected drawdown in crude stockpiles via last night’s API release (-5.22mln vs. Exp. -3.5mln). Elsewhere, the latest reports suggest that Ineos are pressing ahead with repairs on the Forties crude pipeline with their preferred repair option. In metals markets, gold was marginally higher on a tepid greenback, while copper was uneventful overnight and held near this month’s highs. Elsewhere, Chinese iron ore futures were seen lower by 1% overnight after steel prices hit a two-week low.

Leave A Comment