When the Bank of Canada announced its rate hike on July 12th, many analysts started to ring alarm bells about its impact on the highly indebted Canadian consumer. Articles appeared showing the impact on mortgage and other consumer carrying costs, raising the spectre of a major correction in housing prices. While the policy rate increase was a mere 25pbs, from 50bps to 75bps, some analysts stated it was just the beginning of a tightening cycle as the credit markets return to “normal”. Too much is made of the impact of the rate hike and the prospects of a steady tightening cycle. Quoting Shakespeare,” the lady doth protest too much, methinks”.

Focusing on the extent of indebtedness, without a commensurate measure of assets, leaves one with a false conclusion regarding the impact of rate changes on households. A recent study by the Fraser Institute[1]—a conservative Canadian think tank — drives this point home.

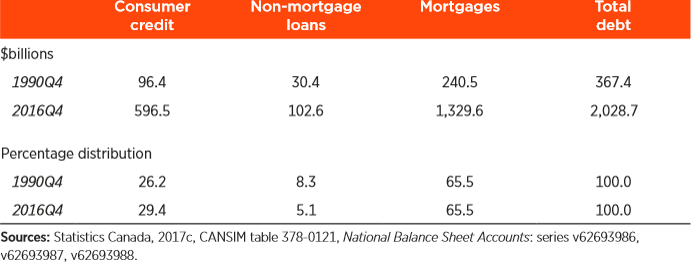

Figure 1 clearly shows that mortgages make up 66% of all household debt, a finding that is not unexpected given the strength in the housing market in the major Canadian cities. Over the 26-year period starting in 1990, mortgage debt as a per cent of total debt has remained constant, while there has been a slight increase in ratio of consumer credit to total debt from 26% to 29%, again not a significant change over time.

Figure 1 Distribution of Debt

Source: Fraser Institute

While Canadian households have taken on more debt over time, they have used this debt to finance assets—real estate and financial assets—that are appreciating over time, causing their net worth to grow (Figure 2). The dramatic growth in total assets compared to total liabilities provides comfort regarding the ability of Canadians to adjust to higher interest rates. More importantly, total household net worth rose from $1.8 trillion in 1990 to $10.3 trillion; as a result, the ratio of net worth to GDP nearly doubled from 265% to 500%. Canadians have been accumulating wealth at a relatively fast pace over the past quarter century.

Leave A Comment