My timing window for a cycle low was wildly unsuccessful; we are now faced with two scenarios.

The technicals (RSI, stochastics, price volume) support the second scenario. Nevertheless, a robust advance on high volume would alleviate the technical divergences thus supporting scenario one.

How do we play this? Scenario one proposes a continued rise into late February before correcting into the next cycle low. However, with the short-term indicators overbought and negative divergences forming, I can’t in good conscience issue a buy signal. Therefore, it is seemingly prudent to exercise patience and wait for a genuine correction.

Scenario two would have prices topping last week, or they could spike a little higher next week. Once the top is in, there should be a 1-2 week correction.

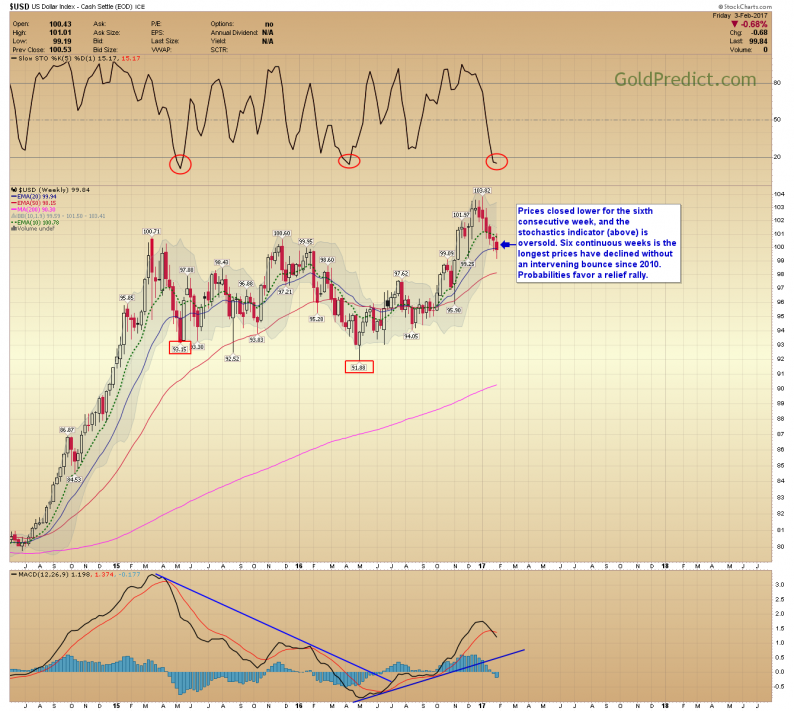

-US DOLLAR WEEKLY- Prices closed lower for the sixth consecutive week, and the stochastics indicator (above) is oversold. Six continuous weeks is the longest prices have declined without an intervening bounce since 2010. Probabilities favor a relief rally.

-US DOLLAR DAILY- Prices failed to hold above the 10-day EMA on Friday, and we are still waiting for a bottom. The RSI (top) has diverged for three weeks further supporting an impending trend change.

-GOLD WEEKLY- Prices have rallied at a sharp angle since the December low and are approaching resistance at the 50/200 week moving averages ($1,230-$1,245). To continue this angle of ascent without a reasonable pullback would be unusual.

-GOLD DAILY- Price volume, MACD (below) and RSI (top) are all diverging supporting the return of a more meaningful correction.

-SILVER WEEKLY- Prices closed higher six straight weeks, and the weekly stochastics is overbought. A pullback is justified.

Leave A Comment