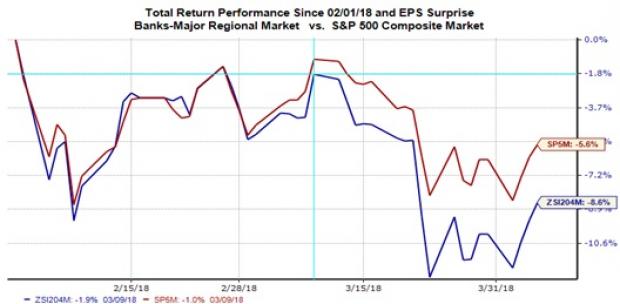

Bank stocks are up +19.2% over the past year, outperforming the broader market’s +15.5% gains and the Finance sector’s +17.7% gain. But the industry has struggled lately, with stocks in the Zacks Major Banks industry down -8.6% since February 1, underperforming the S&P 500 index’s -5.6% decline in that same period, as the chart below shows.

The biggest reason for this recent underperformance is the interest rate uncertainty, which has forced yields on the benchmark 10-year Treasury bond to generally move sideways and down over the last two months. This change in treasury yields represented a notable reversal of the uptrend that had been in place since September last year, during which the 10-year yield moved up more than 80 basis points and appeared poised to cross the 3% level.

Treasury yields have been hard to handicap over the last many years and the ongoing uncertainty on that front, a reflection of safe-haven trades resulting from trade-centric worries and the market’s evolving inflation/Fed outlook, reconfirm the difficulty of forecasting this key metric.

That said, the Fed remains on a steady tightening trajectory, with market uncertainty at present primarily related to whether the central bank will announce four rate hikes, as it has publicly stated, or more than that. But irrespective of whether we have four or more rate hikes this year, there is no question that we are heading towards the Fed Funds rate reaching a ‘normal’ or ‘neutral’ level before the middle of 2019. In other words, it may have been difficult to forecast yields over the last few years, but they should be going up in the months and quarters ahead.

The reason we are talking about treasury yields and interest rates in a discussion about bank earnings is that interest rates act like oxygen for banks. The low interest rates of the last few years, resulting from a deliberate Fed policy, had put a lid on banks’ earnings power. Net interest margin, the difference between what banks pay their depositors and what they charge lenders, has been flat to down for the last few years. With revenue growth hard to come by as a result of this backdrop, banks were forced to maintain profitability by squeezing expenses out of their operations.

All of this has started changing, net interest margins have started expanding, at least on a year-over-year basis, offsetting some of the lingering weakness with loan portfolio growth.

What Are Banks Expected to Report in Q1?

The last earnings season was very messy because of huge one-time charges related to tax law changes, but we should start seeing ‘cleaner’ results from this earnings season onward, with net interest margins potentially coming in better than many analysts have factored in their models.

The sharp uptick in market volatility is also helpful to the big banks’ capital markets businesses and we should see proof of that in trading results from JPMorgan (JPM) and Citigroup (C) as they report results on Friday, April 13th; Wells Fargo (WFC) is reporting that day as well, but it is less of capital markets operator relative to its peers. PNC Financial (PNC) also reporting April 13 isn’t a capital markets player, either.

For the Finance sector as a whole, of which the Major Banks industry is the biggest earnings contributor, total Q1 earnings are expected to be up +19.1% from the same period last year on +4.5% higher revenues. This would follow +0.6% earnings growth in 2017 Q4 on +4% higher revenues.

The sector’s earnings growth pace is expected to materially accelerate in 2018 Q1 and the following quarters, as the chart below shows.

Leave A Comment