The average American household has roughly 6% less spending power than it did a decade ago. How can that be? Hasn’t the economy been expanding at an appropriate clip since the Great Recession? Haven’t median incomes been rising briskly in conjunction with “full employment?”

One of the problems may be attributable to demographic shifts. A rising percentage of young adults are living with their parents longer. Meanwhile, a significant wave of older folks are moving in with their adult children. When one adjusts household income for family size, where more money is required by the multi-generational group, the decrease in living standards may approximate 3%.

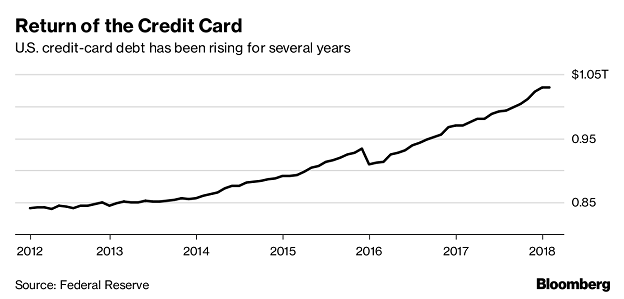

Equally worthy of note, non-mortgage household debt (e.g., student loans, credit cards, etc.) sits 40% above its 2008 peak. The interest payments on these debts for the typical household likely reduces living standards by another 3%.

Keep in mind, credit card debts are also becoming increasingly expensive. For one thing, virtually all cards in the U.S. have variable rates that move higher when the U.S. Federal Reserve raises its overnight lending rate. That 11.99% “bargain” APR? The average today is closer to 16.5%. It might not sound so onerous were it not for the reality that consumers continue using credit to make ends meet.

Investors ignore the evidence on heavy debt loads and rising borrowing costs at their own peril.Yet the debt-to-income picture for consumers is corrosive. Moreover, record highs for residential housing alongside higher mortgage rates imply limited affordability.

Consider the rapid repricing of the 30-year fixed rate mortgage over the previous six months. On a relative basis, the difference between 3.85% and 4.45% may not seem like a big deal. Yet mortgage rates had been so low for so long, the shift has decimated the market for “refis” and reduced the pool of qualified homebuyers.

Leave A Comment