My Swing Trading Approach

I expect to be conservative in my trading approach today, booking gains where it makes sense, and finishing out the year strong.

Indicators

VIX – Fell 2.8%, but still above 10. Look for a potential year-end close below 10.

T2108 (% of stocks trading below their 40-day moving average): Small bump yesterday of 1.5%, closing at 64%. Still indicating a lot of sideways price action.

Moving averages (SPX): Managed to rally at the end of the day, to hold on to the 5-day moving average.

Industries to Watch Today

Basic Materials remains the strongest sector right now, while Financials are starting to wake up. Utilities and Real Estate showing some life, while Technology continues to struggle.

My Market Sentiment

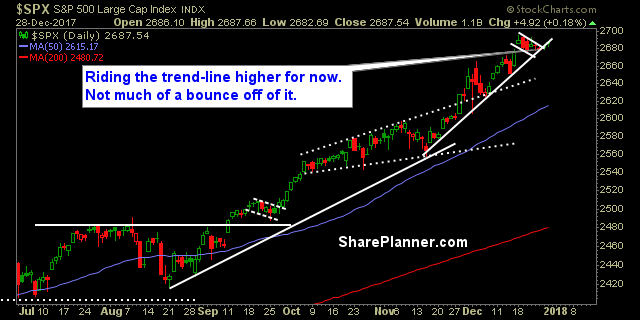

Emerging out of a bull flag pattern. Last day of the trading year tends to have some volatility in both directions and can even see above average volume.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

Recent Stock Trade Notables:

Leave A Comment