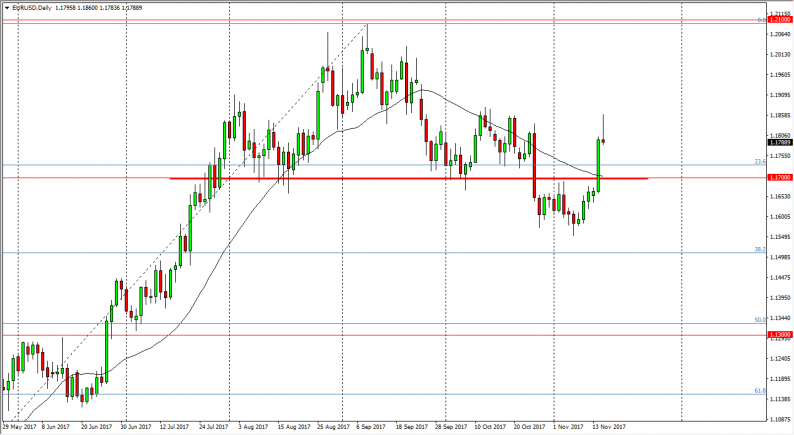

EUR/USD

The EUR/USD pair rally during the day, reaching as high as the 1.1875 region. We pull back from there, to form a shooting star for the day. That shooting star is a very negative sign, and it looks likely that we are going to pull back from there. I also believe that the 1.17 level underneath is massively supportive as it was massively resistive 48 hours ago, but previously it was the neckline for the head and shoulders on the daily chart. I think we pull back from here, it’s likely that the buyers will get involved, but if we were to break down below the 1.17 level, the market rapidly drops down to the 1.16 handle. Alternately, if we break above the top of the shooting star, we will go much higher, perhaps trying to target the 1.21 handle after that.

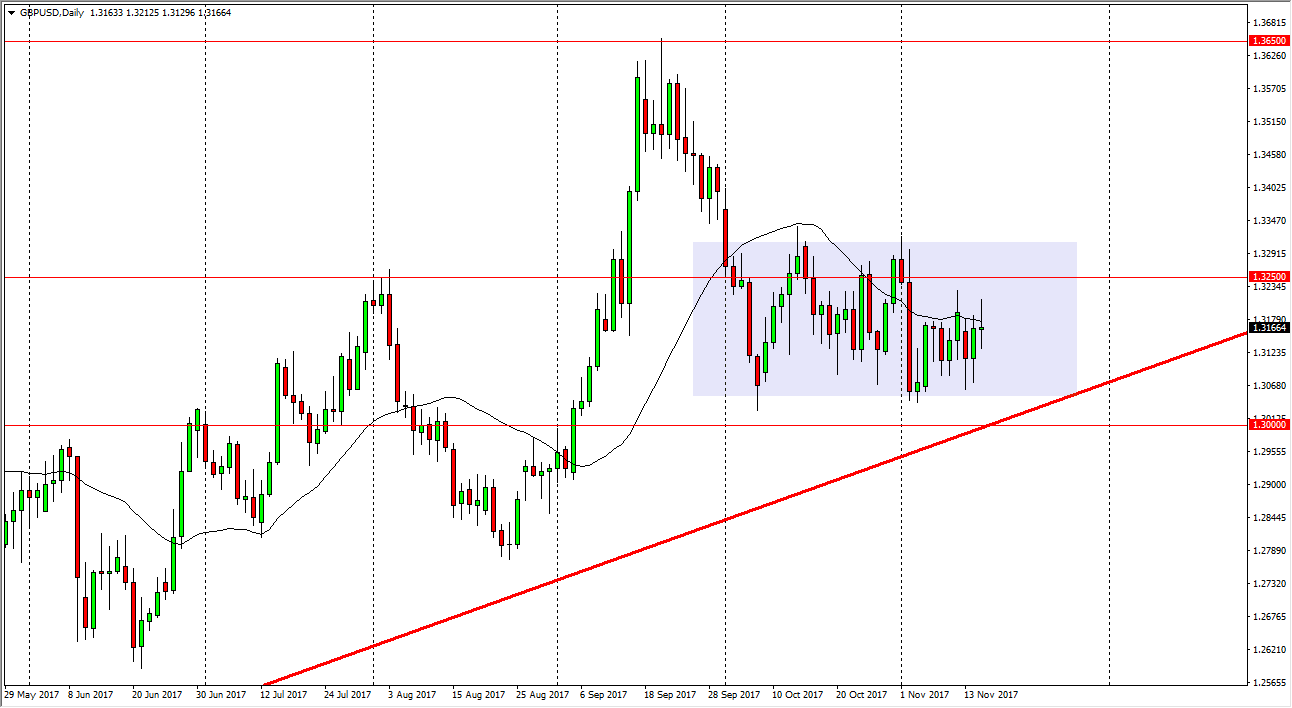

GBP/USD

The British pound was very volatile during the day on Wednesday, forming a neutral candle. It looks as if we are currently stuck in consolidation, with the 1.3050 level underneath offering support, and the 1.3333 level offering resistance. We should continue to go back and forth, and the 1.30 level underneath is the “floor” in the market. The uptrend line also should offer support, so I think it’s only a matter of time before we go higher. That being said, in the meantime I think that the market will essentially chop around, and short-term traders will continue to flock to this market with a range bound type attitude. If we can break above the 1.3333 level, then the market is free to go to the 1.35 handle next. A breakdown below the 1.30 level would be very negative.

Leave A Comment