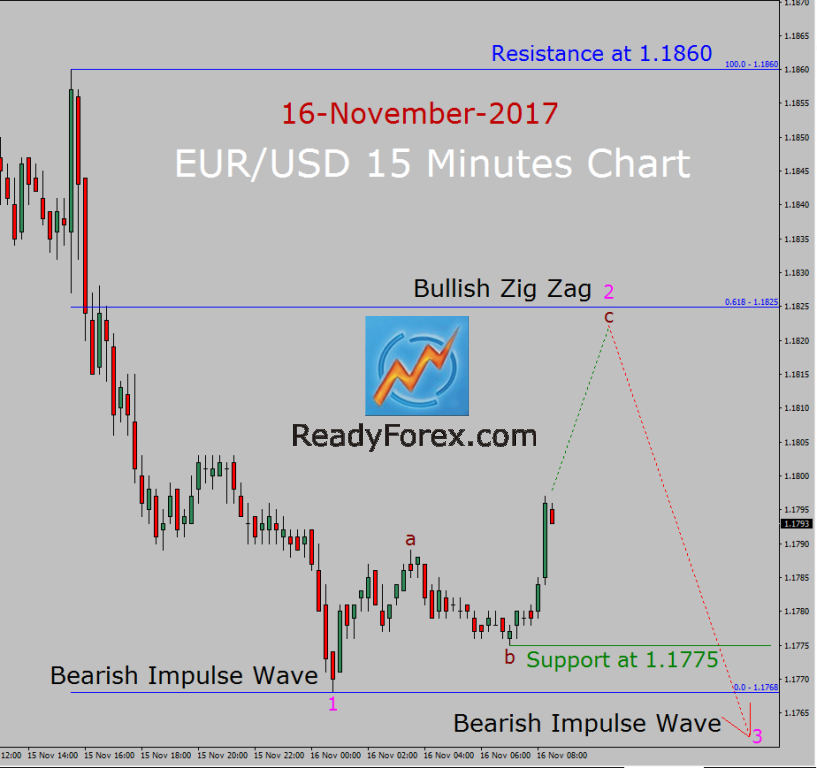

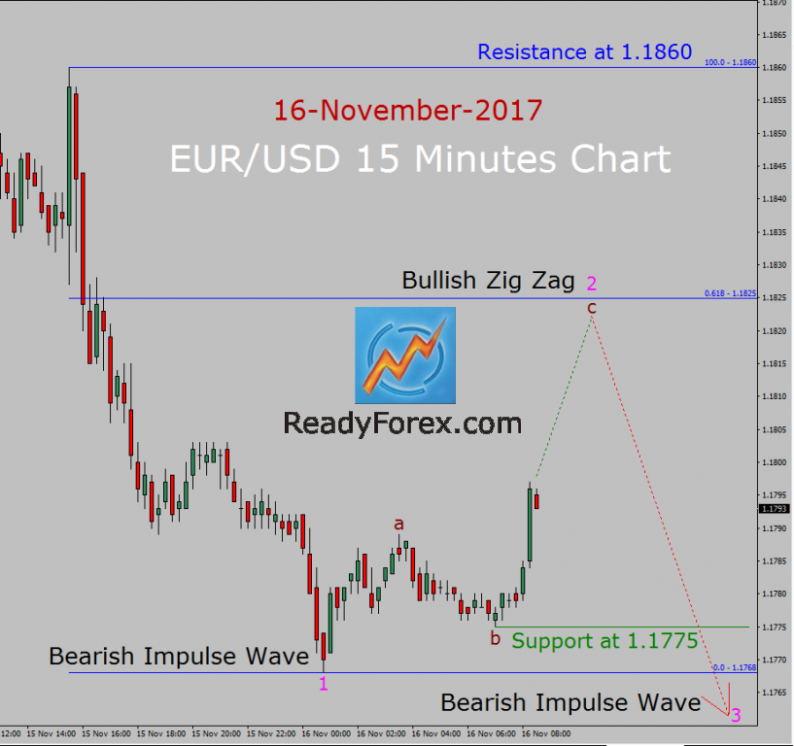

The bearish trend is present in EUR/USD currency pair, 15 minutes chart. The price of EUR/USD currency pair is going to drop now on a short-term basis to create a bearish Impulse Wave 1 Elliott wave pattern and traders should consider taking a possible sell trading chance.

Strong key resistance level is present at 1.1860 price level which is the originating point of bearish wave 1 pattern. In my opinion, price action in EUR/USD currency pair is in the process to complete the bullish Zig Zag corrective wave 2 Elliott wave pattern. So, I expect the market to first move up and then resume the downtrend and falls towards 1.1760 price area in coming trading hours.

Next, price action is most likely going to print a short-term bottom in coming trading hours after completing bearish Impulse wave 3 pattern. As the trend is still bearish, Forex traders should consider only short trades and no trade against the current EUR/USD bearish trend as it is always easy to trade in the favor of market trend.

Currently, bullish wave c of wave 2 corrective Elliott wave pattern looks half finished. A good idea is to wait for the market to first rise up more and then look for a possible sell-trading chance to join the downtrend.

However; if the price action in EUR/USD spot Forex pair breaks above 1.1860 important resistance level then bearish Elliott wave analysis will become in-valid. From this time forward, I may seize the opportunity to stay out of the market and re-assess the EUR/USD currency pair price movement in fifteen minutes chart.

Leave A Comment