EUR/USD enjoyed a second week of advances but the US Dollar is not giving up. What’s next? Preliminary inflation figures for August stand out. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The ECB meeting minutes did not break ground on the usual messages from the central bank: cautious optimism and a gradual removal of the stimulus. On the other side of the Atlantic, the FOMC minutes were upbeat on the US economy and increased the odds of a rate hike in September. The Fed moves forward despite criticism from Donald Trump. The President wants lower rates and temporarily weighed on the US Dollar. Trump was implicated in illegal campaign financing as his former lawyer and “fixer” Michael Cohen testified against him. On the other hand, US-Chinese talks did not go very far and this boosted the greenback. Late in the week, Fed Chair Jerome Powell said he did not see accelerating inflation nor an overheating economy. He also added some conditions to the next rate hikes. That sent the US Dollar lower.

Updates:

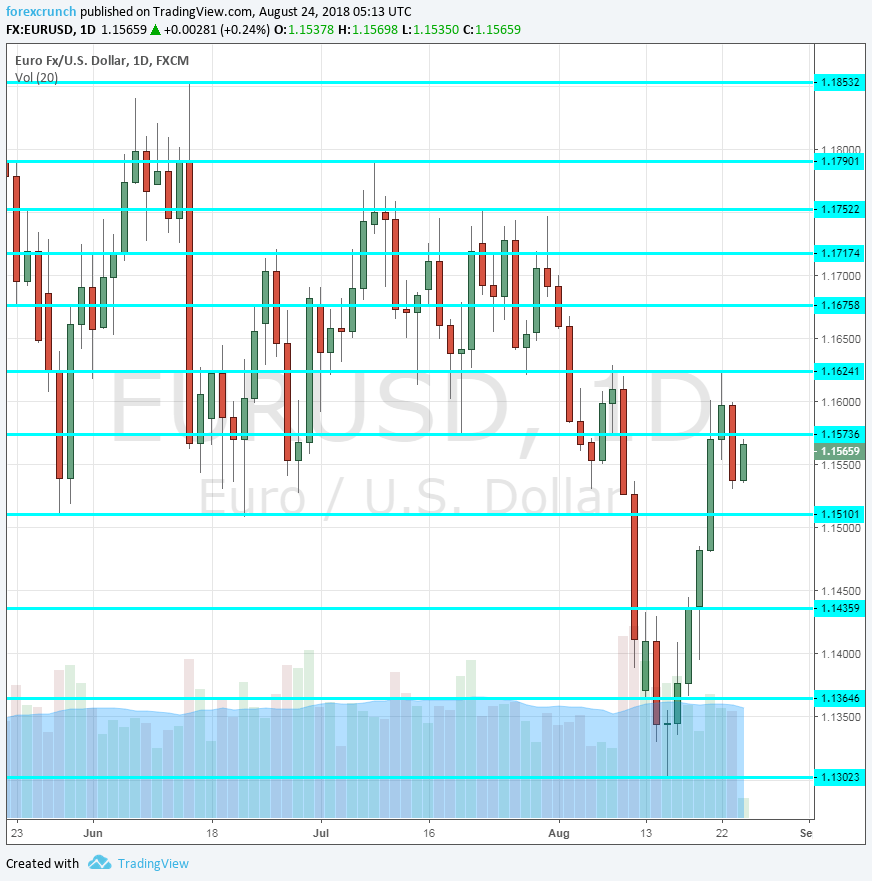

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

Leave A Comment