With Draghi’s Friday comments, which as we noted previously were meant solely to push markets higher, taking place after both Europe and Asia closed for the week, today has been a session of catch up for both Asian and Europe, with Japan and China up 1% and 0.3% respectively, and Europe surging 1.4%, pushing government bond yields lower as the dollar resumes its climb on expectations that Draghi will jawbone the European currency lower once more, which in turn forced Goldman to announce two hours ago that it is “scaling back our expectation for Euro downside.”

And perhaps as if on demand, the euro fell for a second day touching session lows just around the time Goldman’s note hit.

On Friday evening ECB President Mario Draghi defended his measures, saying Thursday’s package wasn’t “meant to address market expectations.” He also stressed the ECB is ready to do more if needed. A stronger dollar has been one of the reasons the Fed has been reluctant to raise interest rates, as it makes American companies less competitive internationally and damps prices on imports. Last week a Bloomberg gauge of the dollar against 10 of its leading global peers had its biggest weekly drop in two months, making it a little easier for the Fed to raise interest rates next week.

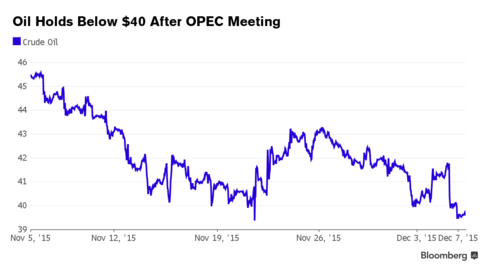

While global stocks have been catching up to the massive US closing surge on Friday, the US itself has been quiet as oil falls for second day after OPEC’s decision to raise its production quota on Friday, sinking even further below 40.

Silver rises, while gold, metals, food commodities fall. This is how global markets look right now:

Other top news stories include China’s foreign reserve drop which declined more than expected to just $3.44 trillion, below the $3.49 trillion expected and down from $3.53 trillion at end of October; Icahn’s Pep Boys stake, Jes Staley’s reported planned cuts, Chipotle warning on E. Coli scare, GE backing out of Electrolux sale, French & Venezuelan votes.

The biggest weekend development in the political arena was the stunning surge in the French National Front, which soared to first place in the French regional elections with 28.1% of the vote.

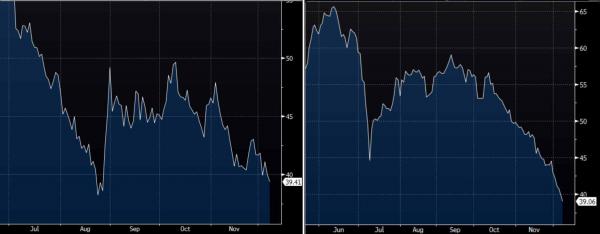

Joining oil below $40 this morning is iron ore which tumbled to the lowest price since May 2009. AsBloomberg reports, iron ore sank below $40 a metric ton on rising low-cost supply from the world’s top miners and weakening demand in China, with investors assessing the impact of the first shipments from Gina Rinehart’s Roy Hill mine within the coming days. Ore with 62 percent content delivered to Qingdao lost 2.4 percent to $39.06 a dry ton, a record low in daily prices compiled by Metal Bulletin Ltd. dating back to May 2009. The raw material is headed for a third annual decline and has lost 80 percent since peaking in 2011 at $191.70.

Here is how the two key commodities looked like as they now are set to race each other who can hit $30, then $20 first.

Looking closer at regional markets, Asian stocks kicked off the week on the front foot following the strong lead from Wall Street. This came after the better than expected NFP report and upward revisions, which hinted at further strength in the US economy. As such, the Nikkei 225 (+1.0%) has pared over half of Friday’s losses, while the ASX 200 (+0.1 %) was initially lifted higher by material names amid the gains seen in the precious metals complex. However, did pull off best levels with pressure from energy stocks after oil prices continued to find no reprieve with investors disappointed by OPECs decision to keep producing at record levels. Elsewhere, Shanghai Comp. (+0.3%) fluctuated between gains and loss with strength in healthcare names.

Top Asian News:

In Europe, the slew of critical macroeconomic events last week, which included the ECB and the NFP, meant that the typical December Santa Claus rally can finally kick off. Nevertheless, the upside in stocks (Euro Stoxx: +1.8%) was led by the more defensive sectors such as health care, underpinning the fragile nature of the recovery, especially since market participants remain particularly wary of risks surrounding the upcoming FOMC decision. Despite the apparent risk on sentiment, Bunds remained better bid, as somewhat dovish comments by Draghi late Friday, together with the release of biggest fall in Chinese FX reserves since August (USD 3438.3bIn vs. Exp 3492.5bIn), supported the flow into safe-haven securities. Also of note, analysts at IFR suggest that model driven buying has added to the real money buying behind the bid tone seen so far today.

Leave A Comment