After a strong start to the day, the bulk of economic data is somewhat more mixed. Euro-zone GDP was confirmed at 0.6% q/q and 2.5% y/y. The German ZEW Economic Sentiment rose to 18.7 points but this fell short of 20 points expected. Yet the current conditions are up to 88.8, which is above predictions. Industrial output slipped by 0.6% as expected but rises 3.3% y/y, which is a small beat.

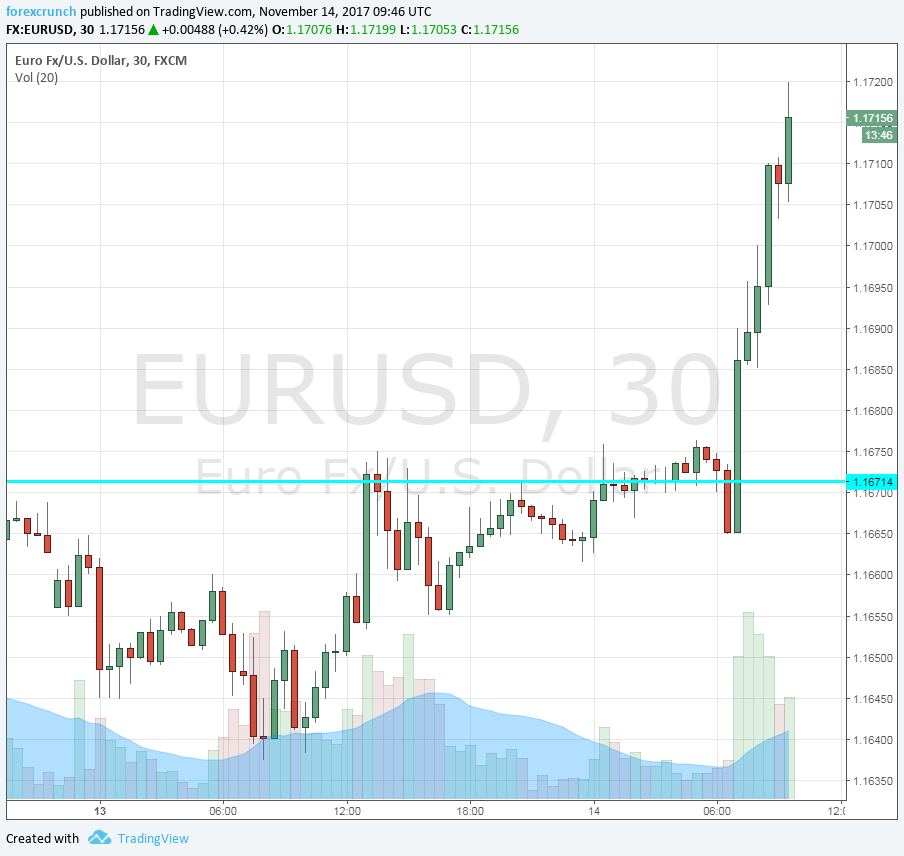

All in all, the mixed data allow EUR/USD to consolidate its gains around 1.1715. It now awaits Mario Draghi.

The euro-zone was originally expected to confirm the quarterly growth rate of 0.6% in Q3, but the upbeat data from Germany probably triggered an upgrade in these estimates. Year over year, the original publication stood at 2.5%, and the German numbers pushed it higher.

EUR/USD was moving on up ahead of the big chunk of economic releases, trading around 1.1718, some 50 pips up on the day.

The German ZEW Economic Sentiment was forecast to rise from 17.6 in October to 20 points in November. The current conditions component was projected to tick up from 87 to 88 points.

In addition, industrial output was estimated to drop by 0.6% m/m and rise by 3.2% y/y, worse than beforehand. Italy’s q/q GDP figures met expectations at 0.5% but beat on the annual measure

Apart from this big bulk of data, ECB President Mario Draghi is hosting a conference with his top-tier peers: Fed Chair Yellen, BOJ Governor Kuroda, and BOE Governor Carney.

Here is how the recent rise looks on the chart:

Leave A Comment