Previous:

On Monday the 2nd of April, trading on the EURUSD pair closed down. The single currency rose during the European session to 1.2345. The main factor behind the dollar’s decline was the decision by Chinese authorities to impose import tariffs on US products.

As exchanges opened in the US after the Easter break, the situation turned completely on its head as traders retreated towards safe haven assets, which brought about a minor collapse in oil prices and stock indices. Experts believe that a trade war between the US and China could lead to reduced demand for oil. The yen has gained about 100 pips against its rivals. Gold has appreciated by 19 USD to reach 1,344 USD per Troy ounce.

Aside from China’s decision, Donald Trump took aim at retail giant Amazon, saying that the company doesn’t pay enough in taxes, which is hurting the economy. In other news, Apple has announced that it plans to stop using Intel chips in its computers.

The euro dropped to 1.2282, but is now recovering as the dollar is losing ground across the board.

Day’s news (GMT+3):

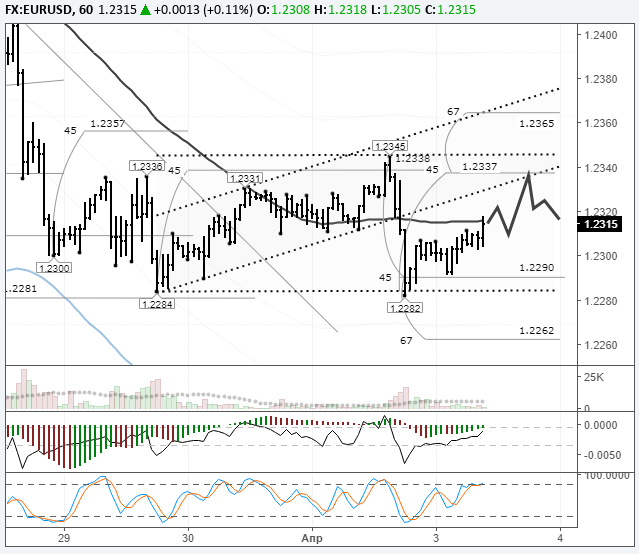

Fig 1. EURUSD hourly chart. Source: TradingView

On Monday, the euro lost 45 degrees against the dollar. The decline came to an end at the low level from the 29th of March. At the time of writing, the euro is trading at 1.2321. This marks a recovery of 39 pips. Given that the dollar is currently declining on all fronts and half of the euro crosses are trading up, I expect the pair to continue rising as far as 1.2337 (45 degrees from 1.2283).

Leave A Comment