Last week, several U.S. economic reports were released. What do they imply for the gold market?

The FOMC meeting and parliamentary election in the Netherlands prevented us from covering recent economic data coming out from the U.S. Let’s catch up. First of all, inflation continued to strengthen. Consumer prices increased 0.1 percent last month, according to the Bureau of Labor Statistics. It was the smallest rise since last summer and much below a 0.6 percent surge in January. Core CPI, which excludes the volatile energy and food categories, increased 0.2 percent, only slightly faster. However, overall CPI rose 2.7 percent on an annual basis, the highest level since early 2012. Core CPI jumped 2.2 percent over the last 12 months.

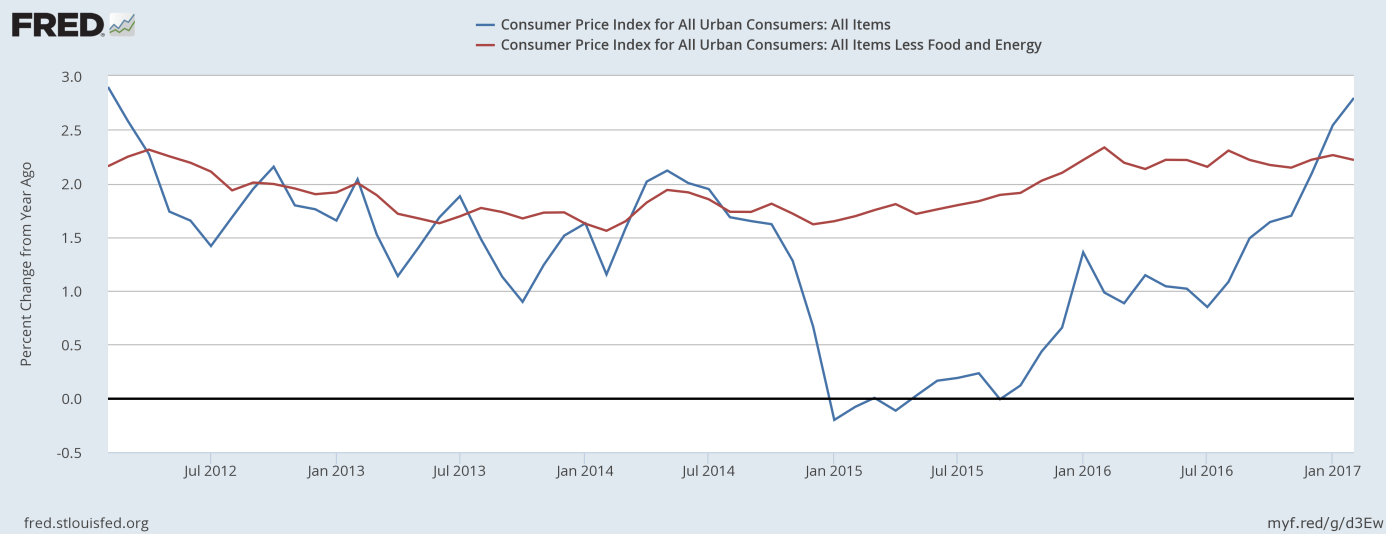

As one can see in the chart below, the overall consumer inflation rate significantly accelerated over the last several months. The inflation rate rose from 0 percent in September 2015 to almost 3 percent currently. It strengthens the hawks’ camp in the U.S. central bank, which is generally bad news for gold bulls. However, until the Fed remains behind the curve, gold may gain due to lower real interest rates.

Chart 1: CPI (blue line) and core CPI (red line) year-over-year from February 2012 to February 2017.

When it comes to other data, retail sales rose just 0.1 percent in February, following a 0.6 percent jump in January. Weak sales – despite unseasonably warm weather, are a negative surprise, which does not bode well for economic growth. As a reminder, the Atlanta Fed’s GDPNow model forecasts real GDP growth in the first quarter of 2017 at only 0.9 percent.

National industrial production was flat in February, but regional manufacturing indices, such as Philly Fed and Empire State remained at high levels in March (although they corrected a bit). Permits to build new homes dropped 6.2 percent, but housing starts climbed 3 percent in February. And the sentiment among home builders also surged, as the National Association of Home Builders’ confidence index jumped 6 points to 71 in March, the highest level since June 2005.

Leave A Comment