In addition to hiking today, the Fed announced its Plan to Shrink Asset Holdings Beginning This Year.

Balance sheet reduction hasn’t started yet, nor did the Fed even say when it would start. Since the Fed will announce the start date in advance, its eye would appear to be focused on December.

Once balance sheet reduction starts, the cap will be $10 billion a month rising to $50 billion a month, on a schedule not posted.

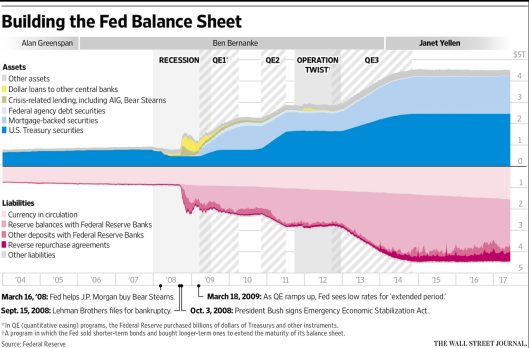

How to Build Up a Balance Sheet

The initial $10 billion cap on reductions is $6 billion in Treasury securities and $4 billion in mortgage bonds.

The maximum reduction rises to $50 billion a month, $30 billion a month for Treasurys and $20 billion a month for mortgage securities.

How Long Will It Take?

At $10 billion a month, $120 billion a year, it would take the Fed 29 years to reduce its balance sheet to $1.0 trillion from $4.5 trillion.

At $50 billion a month, $600 billion a year, it would take 5.8 years. If the Fed slowly ratchets up its cap, we are talking about a 10-year time frame.

Those are the absolute minimum and maximums assuming the Fed starts reduction and does not stop until it’s done.

Those timeframes are highly unlikely in actual practice because they presume the Fed won’t halt or reverse balance sheet reductions when the next recession starts.

From a practical standpoint, somewhere between 30 years and never is about right.

Build Me Up Buttercup

In honor of the next Fed asset build-up, I offer this musical tribute.

Mike “Mish” Shedlock

Leave A Comment