“You’re such an idiot,” one of my new hedge fund manager reader friends wrote me the other day. “You spent the last couple of years warning about the possibility all of this Central Bank monetary madness causing a huge rip higher in risk assets. And here we are, it is finally here, and instead of taking a victory lap, you are monkeying around trying to fade the rally by buying Nasdaq put spreads. You’re incorrigible”

Yeah, my pal is right. If I am being honest, this is my biggest weakness. Too often I am contrarian to the point of my own detriment. I have never been good at riding an overly popular trade to its fullest.

It was easy for me to trade stocks from the long side when everyone was scared about the next crash. Yet now that most everyone has abandoned their fear, I find it almost impossible to stay long as they push it higher and higher.

And to be truthful, for a fleeting moment last week, I felt like I might do the impossible, and catch the top in the stock market. After grinding higher for the past week during the Chinese Communist Party Congress meeting, as Beijing was wrapping up, stocks finally looked like they were ready to sell-off.

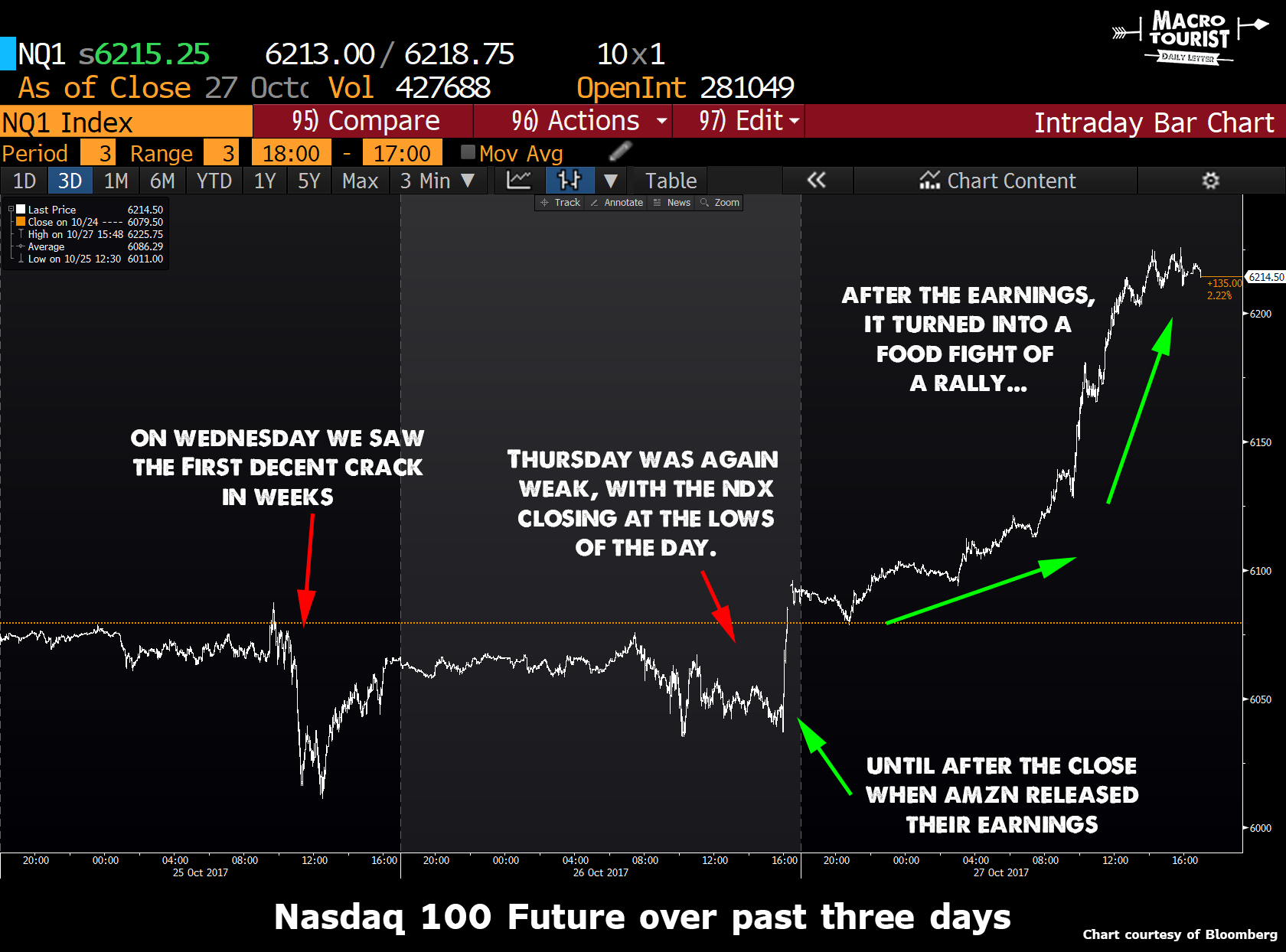

Yet after two poor trading days mid-week, Thursday after the bell; Amazon, Google and Microsoft released their earnings and sparked one of the biggest Nasdaq rallies of the past decade.

But the really interesting part? The rally was extremely narrow. Here is a chart of the Nasdaq 100 daily performance compared to the Nasdaq 100 equal-weighted index.

I didn’t come up with the idea for this chart. Instead I stumbled upon the stat in a market commentary, but couldn’t find the actual chart. So I thought it needed to be created as, in the history of the Nasdaq 100 equal-weighted index, the NDX has never outperformed by as much as Friday’s 2.8% face ripper.

Now don’t worry. I will not become some bitter short seller that just sits in a bathrobe screaming at kids to get off his lawn. Yet I must admit to being thankful that I expressed my short side trading stab using cheap options instead of outright futures.

And before I go any further, I should have known better. The Market Gods were bound to reign down their vengeance as, the previous week, Reformed Broker’s Josh Brown’s article “Just own the damn the Robots” took an awful amount of flack (some of that from yours truly – “The Winners of the New World Redux”).

It was the famous speculator Bernard Baruch who said, “the main purpose of the stock market is to make fools of as many men as possible.” Although this quote should probably be updated to include women, it is just as relevant today as it was decades ago.

It should be no surprise that given the huge pushback to Josh’s article, the Market Gods’ next move would be to make fools out of all of Josh’s critics and send the FANG stocks screaming higher.

Leave A Comment