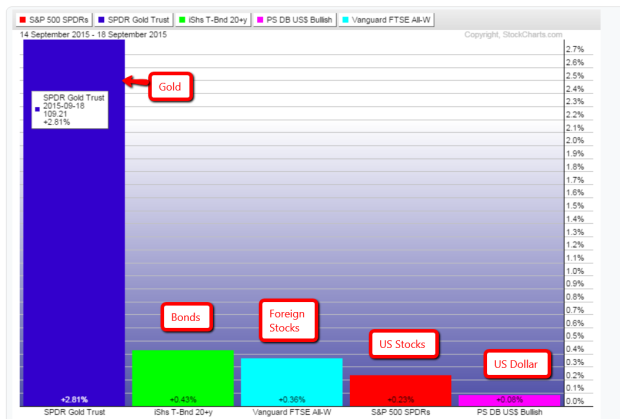

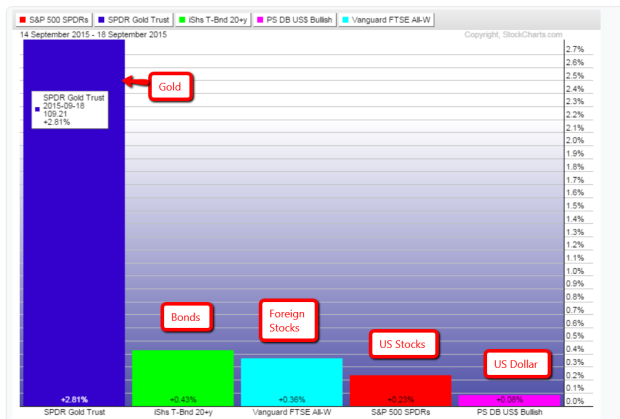

Last week was a week full of economic data and central bank announcements. Gold came out as the biggest winner, sporting a gain of 2.81%, while stocks, bonds and the dollar eked out minor gains.

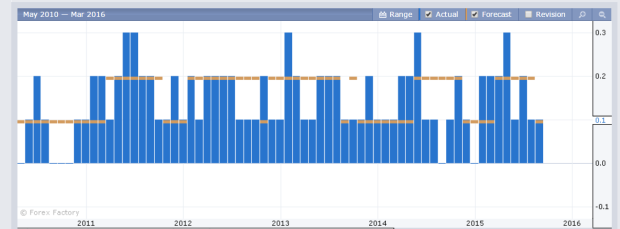

Retail sales came out on Tuesday, showing a month over month increase of 0.2% while the street was expecting a gain of 0.3%.

On Wednesday the Core Consumer Price Index (CPI) showing a month over month increase in line with expectations of 0.1%. This excludes food and energy and it’s the main indicator used by the Fed in gauging inflation in their mandate to promote price stability.

The big letdown for the week was the Philly Fed Manufacturing index on Thursday. The expectations were for a reading of 6.1, while the actual number came in at a negative 6.0. We have seen worse readings in the last few years, nonetheless this wasn’t a good outcome.

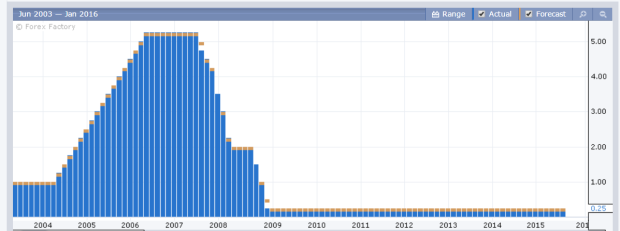

Without a doubt the biggest event last week was the Federal Open Market Committee (FOMC) meeting, press conference, and economic forecasts. There was much speculation around this event in terms of raising the short term rate. Before the August stock market sell off it was a 50/50 proposition. By Thursday it was priced in as only a 30% chance. As it turns out, the majority were correct. The Fed kept short term interest rate at 0%, were it has been for almost seven years. They cited global market concerns as a main reason.

It is my opinion that the Fed has no plans to raise the Fed Funds rate until March 2016 or later. The Fed has historically been reactive, not proactive, to policy changes in either direction (whether easing or tightening). By keeping the threat of a rate increase open since last year, I believe they are attempting to keep any potential bubbles in financial markets from getting too out of hand. Of course bubbles are usually hard to identify until it’s too late. I could be wrong (I hope I am wrong) but I believe the Fed will maintain status quo until next year.

As for the Fed’s economic projections, there wasn’t a lot of change in their long term forecasts that I could see. They maintain longer run GDP projections of 2.0%, Unemployment rate of 4.9% and PCE Inflation of 2.0%. 13 of 17 FOMC participants believe 2015 is still the appropriate time for the first increase in the Federal Funds rate.

Leave A Comment