There has been much speculation whether foreign official institutions (central banks, SWFs, reserve managers and so on) are selling Treasurys or equities, or both as part of the Quantitative Tightening phenomenon.

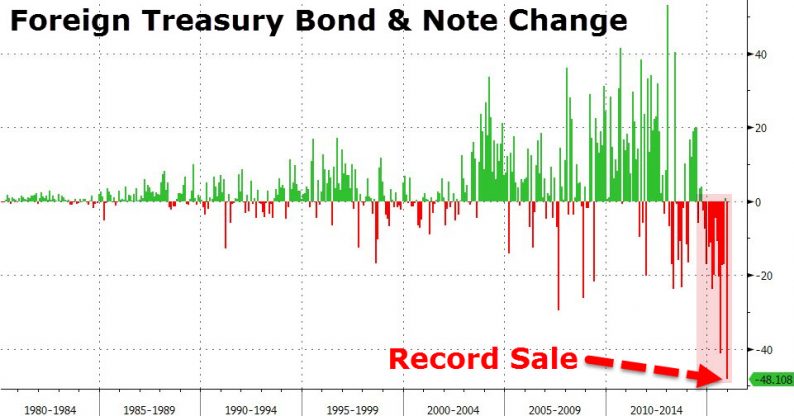

Moments ago, courtesy of the latest TIC data we have an answer: based on the monthly flow report breaking down Treasury transactions between foreign official and private entities, in December the far more important, former, group sold $48.1 billion in US Treasurys: the highest single monthly outflow on record.

This was partially offset by a $12.2 billion purchase by Private buyers, however as the chart below shows, on an LTM basis, December saw a total of $20.3 billion in selling, and was the third consecutive month of net selling by foreigners. This was the first such occurrence in 15 years.

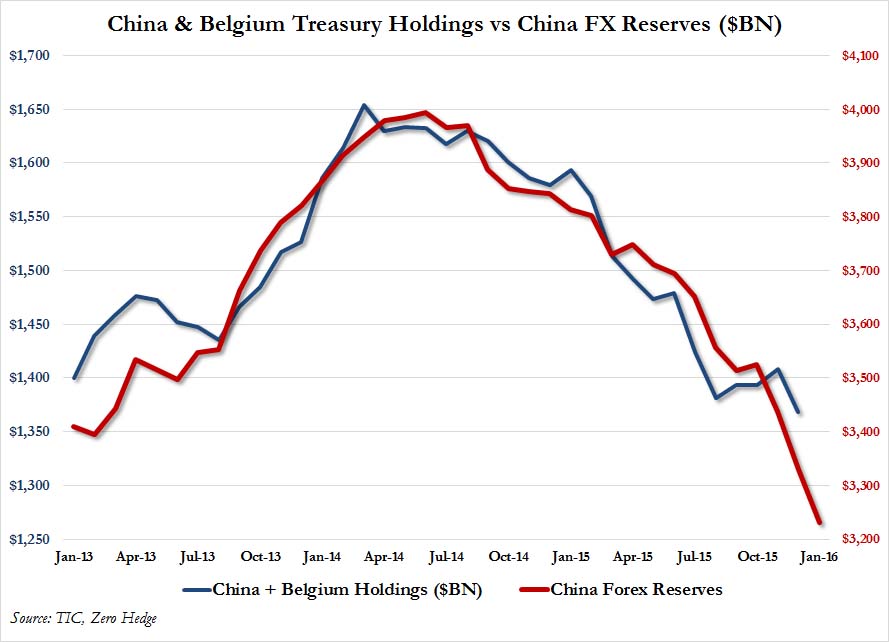

Finally, for all those curious what China is doing with its US Treasury holdings, using the TIC’s stock data, we find that between China and its offshore trading proxy “Belgium”, China dumped another $41 billion in TSYs, a move which continues to track the decline in its official reserve holdings almost TIC for TIC, pardon the pun.

Leave A Comment