We mentioned in a recent post that we would soon return to the topic of credit spreads and exotic structured products. One reason for doing so are the many surprises investors faced in the 2008 crisis. Readers may e.g. remember auction rate securities. These bonds were often listed as “cash equivalents” on the balance sheets of assorted companies investing in them, but it turned out they were anything but. Shareholders of many small and mid-sized companies learned to their chagrin that quite a bit of this “cash” had for all practical purposes evaporated when the markets for these bonds suddenly froze.

Surprise and shock at the sudden emergence of exotic securities in unexpected places at an inconvenient moment.

We have regularly chronicled the growing insanity in bond markets over the past few years, since we feel quite certain that debt will once again prove to be the straw that breaks the bubble’s back, so to speak. The massive surge in “cov-lite” bond issuance in the corporate junk bond universe almost speaks for itself, as does the popularity of “frontier market” government bonds or bonds issued by parastatal entities in these markets (“frontier markets”).

The same applies to the resurgence in CLO issuance. Investors in these products often employ up to 10:1 leverage; reportedly banks are eagerly supplying the funds, since back-testing clearly shows that nothing bad ever happened to these carefully over-collateralized cesspools of potential deadbeat debt – and as everybody knows, that means nothing bad will ever happen. Just as there was never supposed to be a nationwide collapse in home prices, this is basically the next double plus-certain thing, which means there is little choice but to slap an AAA rating on most of these securities. Et voila, 10:1 margin is no problem; this kind of leverage was first tested by the customers of bucket shops in the roaring 20’s, and for a time it was quite popular.

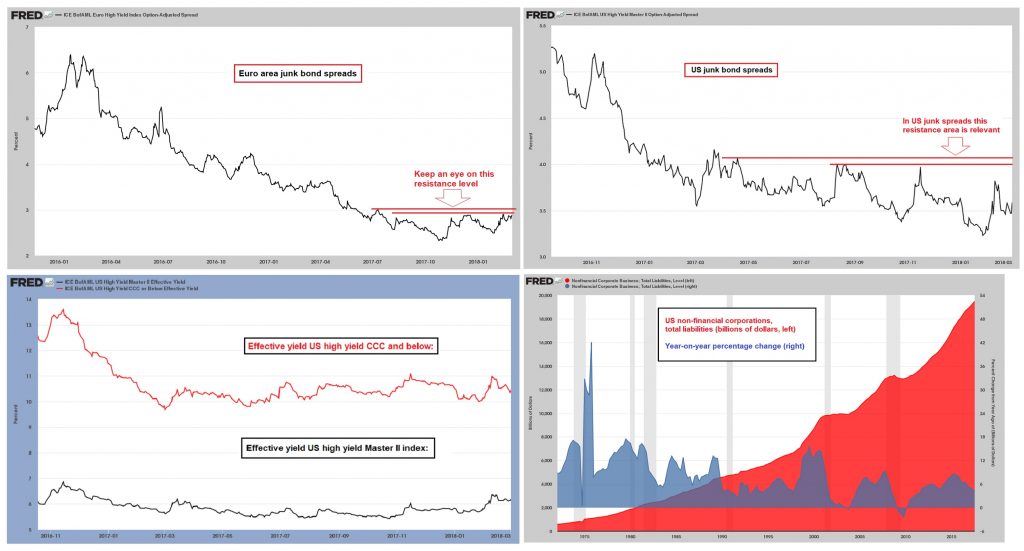

Besides, if one looks at credit spreads one really has to wonder what the stock market is getting so concerned about lately. Credit spreads are clearly telling us that investors in their collective wisdom expect almost no corporate defaults in the coming year, despite the fact that the corporate debtberg is of unprecedented magnitude both in absolute and relative to everything terms.

Behold the amazing resilience of the credit markets. Both euro area and US junk bond spreads remain close to all time lows, and the same is true of their effective yields (note that euro area junk spreads have recently widened a bit more because the yield spread between German sovereign bonds and US treasuries has increased – for instance, the yield on 10-year Bunds was recently at just 0.65% vs. the 2.86% yield on 10-year treasuries – interestingly, these securities were trading at the same yield as recently as late 2014). Since the “great crisis”, the mountain of corporate liabilities has grown to the sky and beyond – but so what?

Unfortunately we also have to mention the concept of reflexivity again… just throwing the three surviving bears a bone, as it were. The lack of expected defaults depends mainly on one thing: the willingness of investors to keep funding borrowers when they need to roll over maturing debt.

As most bond investors presumably know, corporate mandarins are investing these borrowings quite wisely, by buying back the egregiously undervalued shares of their companies. The resultant decline in share floats helps to highlight what admirable earnings powerhouses many of these enterprises are. Where otherwise there may well be nothing, one now finds respectable growth in EPS. What’s not to like?

Financial Engineers Never Sleep – From Soviet Dams to Gemstones

Leave A Comment