It should also be a busy week for sterling with a Bank of England monetary policy announcement, retail sales, consumer prices and labor market reports scheduled for release. After numerous tests, GBP/USD rejected 1.40 and appears on its way back down to 1.3800. Whether this key level is broken or not will be determined by the BoE and FOMC rate decisions.

American policymakers meet before the Brits and they are widely expected to raise interest rates for the first time this year. Yet what’s important is not the rate hike but their guidance on future tightening. If the dot plot shows policymakers leaning towards 3 instead of 4 hikes, the dollar should fall, driving GBP/USD higher. If it shows 4 instead of 3, GBP/USD could fall aggressively. As for the BoE, at the last meeting sterling shot higher after the central bank raised their 2018 and 2019 GDP forecasts adding rates may need to rise faster and earlier than previously expected. This hawkishness caught the market by complete surprise. Although here’s been more weakness than strength in the U.K. economy since the last meeting (manufacturing activity slowed, retail sales growth barely turned positive) and consumer price pressures eased, its unlikely that the central bank will walk back their positive outlook so quickly. This is not a monetary policy announcement that is accompanied by a press conference by Mark Carney (like the last one) so the statement is likely to be unchanged.

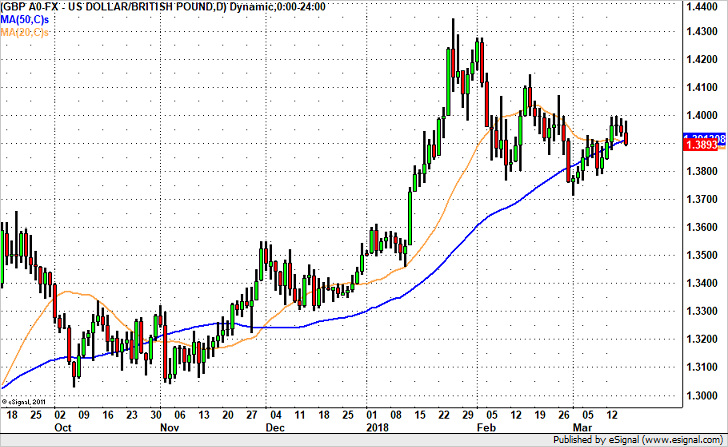

Technically, after a series of lower highs and lower lows, GBP/USD has broken below the 20 and 50-day SMA. This move is not only bearish but signals a potential move below 1.3800.

Leave A Comment