While euro was making multi-month highs cable was floundering all day long despite hotter than forecast inflation data. But as we explained earlier in the day, investors feared that higher inflation rates will continue to weigh on the consumer. The Bank of England has categorically ruled out any rate hikes in the foreseeable future, so any spikes in inflation are now viewed as negative for the currency especially if UK Retail Sales continue to disappoint.

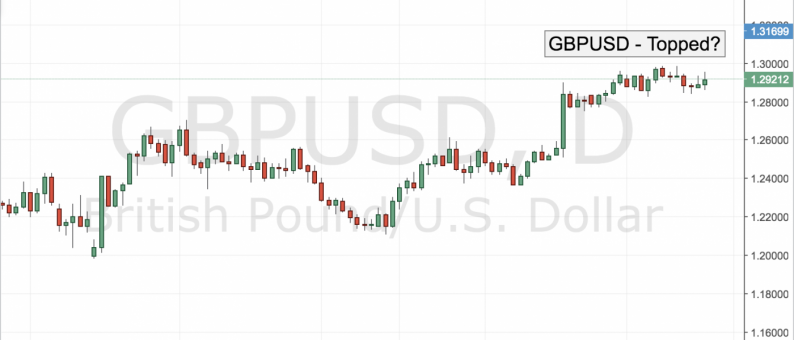

Cable has now stalled in front of the key 1.3000 figure and if it continues to drift lower giving up the 1.2800 handle it will likely have put in a near-term top as investor enthusiasm for the pair continues to wane. Tomorrow the pair may get some reprieve if UK labor data proves positive, but much will depend on the wage component of the report. Even of labor demand is robust, but wages lag the real wages numbers will actually turn more negative because of rising inflation and the market could send cable through the key 1.2800 support, confirming a near term top.

Leave A Comment