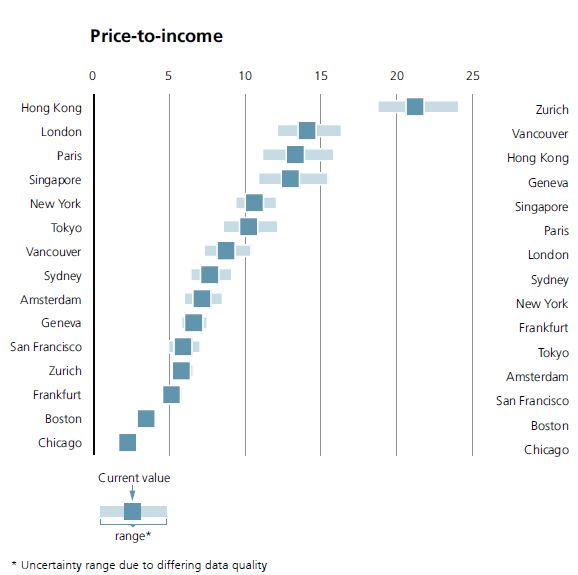

For some time I have argued that global property markets are overvalued. The reason is simply that price to average eaenings ratios are too high and also price to rent ratios are very high making the yield on property too low. This is confirmed in a recent UBS wealth report (UBS Global Real Estate Bubble Index). Below is the price to income ratio, except we are talking about the income levels of skilled workers in these cities not average incomes in these cities. In London the price to skilled income is now 14 times a skilled wage by comparison in Boston it is less than 5 times a skilled wage. By the way we are talking of only a small 60 metre square apartment here not a family sized property!

Source UBS

Next when we look at average price to rental yields we get a similarly poor picture – a price to rent of over 30 means a 3.33% or less rental yield which is way too low. By contrast a 15 times price to rent implies a rental yield of 6.66% still low but I suppose reasonable in todays low yield world. Anything over 20 looks to me to be well overvalued !

Source UBS

The fact is that low interest rates both short and long term brought about by ultra loose monetary policy and quantitative easing policies have created yet another bubble. The capital appreciation on property has paid off handsomely for speculators in recent years but now is the time to get out of this market. The old adage “sell high buy low” now applies and it is tiime to sell ! Remember this – property can prove to be a very illiquid asset in a falling market – you can’t sell unless you reduce your price dramatically. As interest rates start to rise in 2016-17 I am sure property will take a major hit.

Leave A Comment